(Bloomberg) — Chile, the world's leading copper producer, raised its metal price projection, citing a rise in commodities exacerbated by Russia's invasion of Ukraine.

The Chilean Copper Commission (Cochilco) expects prices to average US$4.40 a pound this year, it said in a presentation on Thursday, compared to an estimate of US$3.95 made three months ago.

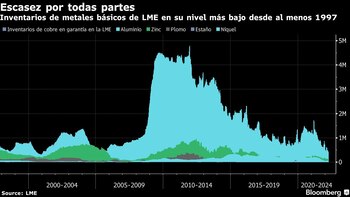

Stored stocks of metal used in wiring are the lowest in more than a decade after the economy recovered from closures due to the pandemic and as demand for electric vehicles and renewable energy begins to increase in the energy transition. At the same time, the war in Ukraine has exacerbated supply constraints on a number of commodities, including copper. Russia accounts for about 4% of world metal production.

All of that is likely to offset a covid-related slowdown in China and the strength of the US dollar to leave the copper market in deficit this year as demand outstrips supply, according to Cochilco.

That shortage will ease next year, and prices will fall again to an average of US$3.95 a pound, the government agency said. Further geopolitical deterioration could push copper prices even higher, although that would leave great uncertainty in demand.

The increase in prices for copper producers is offset by rising energy, steel and transportation costs, as well as increases in processing fees that mining companies pay smelters, Cochilco said.

The agency expects Chile's copper production to recover after water restrictions and low ore laws drove production in the first months of the year, with some growth for the year.

Original Note:

Top Copper Nation Chile Boosts Outlook as War Adds to Tightness

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Últimas Noticias

Debanhi Escobar: they secured the motel where she was found lifeless in a cistern

Members of the Specialized Prosecutor's Office in Nuevo León secured the Nueva Castilla Motel as part of the investigations into the case

The oldest person in the world died at the age of 119

Kane Tanaka lived in Japan. She was born six months earlier than George Orwell, the same year that the Wright brothers first flew, and Marie Curie became the first woman to win a Nobel Prize

Macabre find in CDMX: they left a body bagged and tied in a taxi

The body was left in the back seats of the car. It was covered with black bags and tied with industrial tape

The eagles of America will face Manchester City in a duel of legends. Here are the details

The top Mexican football champion will play a match with Pep Guardiola's squad in the Lone Star Cup

Why is it good to bring dogs out to know the world when they are puppies

A so-called protection against the spread of diseases threatens the integral development of dogs