The Mayor's Office of Bogotá reported that citizens can now access invoices for property tax, which can be downloaded through the new platform of the Ministry of Finance. To access and carry out any electronic procedure related to this obligation, taxpayers must be registered with the Virtual Office with an email and password.

Finance Secretary Juan Mauricio Ramírez explained that the new platform “will simplify procedures and provide complete, accurate and timely information to the more than 2.6 million Predial taxpayers in Bogotá, including those who are going to pay in installments.”

How to register in the Virtual Office?

1. Taxpayers must visit the official website of the District Treasury Secretariat.

2. Go to the Virtual Office section and click on 'Register new virtual office' and then 'Register here'.

3. Select the type of document with which you are going to register and fill in the data requested.

4. Click on the 'OK' option.

5. Answer the validation questions that the system throws up and click 'Submit'. It should be remembered that if the answers are not correct, the system will not allow you to move forward in the process.

6. Create your username and password. If you have previously registered an email on the page, this will appear, but you can modify it if you want.

7. You will receive an email confirming your registration to activate your account.

One of the novelties of this Virtual Office is that the taxpayer's user will no longer be their ID number, but an email, which with a secure password will henceforth allow the procedures to be carried out.

How to download and pay the Property Tax?

After making the respective registration, citizens can go to the page of the Bogotá Treasury Secretariat, to download and pay the respective invoice. Here are the steps to follow:

1. Find the Virtual Office part and select the 'Unified Property Tax' button.

2. Login with the email and password that were previously created.

3. Click on the 'Taxpayer' button to make all transactions and payments.

4. Select the 'Billing' tab.

5. In the drop-down tabs choose the 'Property tax' options, select the year 2022 and click 'Search'.

6. A box will appear where you will find the option to download the invoice and also to make the respective payment.

Strata 1, 2 and rural with physical invoice

Faced with the new change, the district administration determined that in order to facilitate the declaration of the obligation to populations that have difficulties in accessing the new technological means, it will make an exception.

The Mayor's Office will send the physical bills to almost 700,000 properties in strata 1, 2 and rural and to 260,000 stratum 3 homes, whose properties are owned by adults over 60 years of age. These people will be able to comply with the payment of property tax through traditional channels.

Property Tax Payment Dates

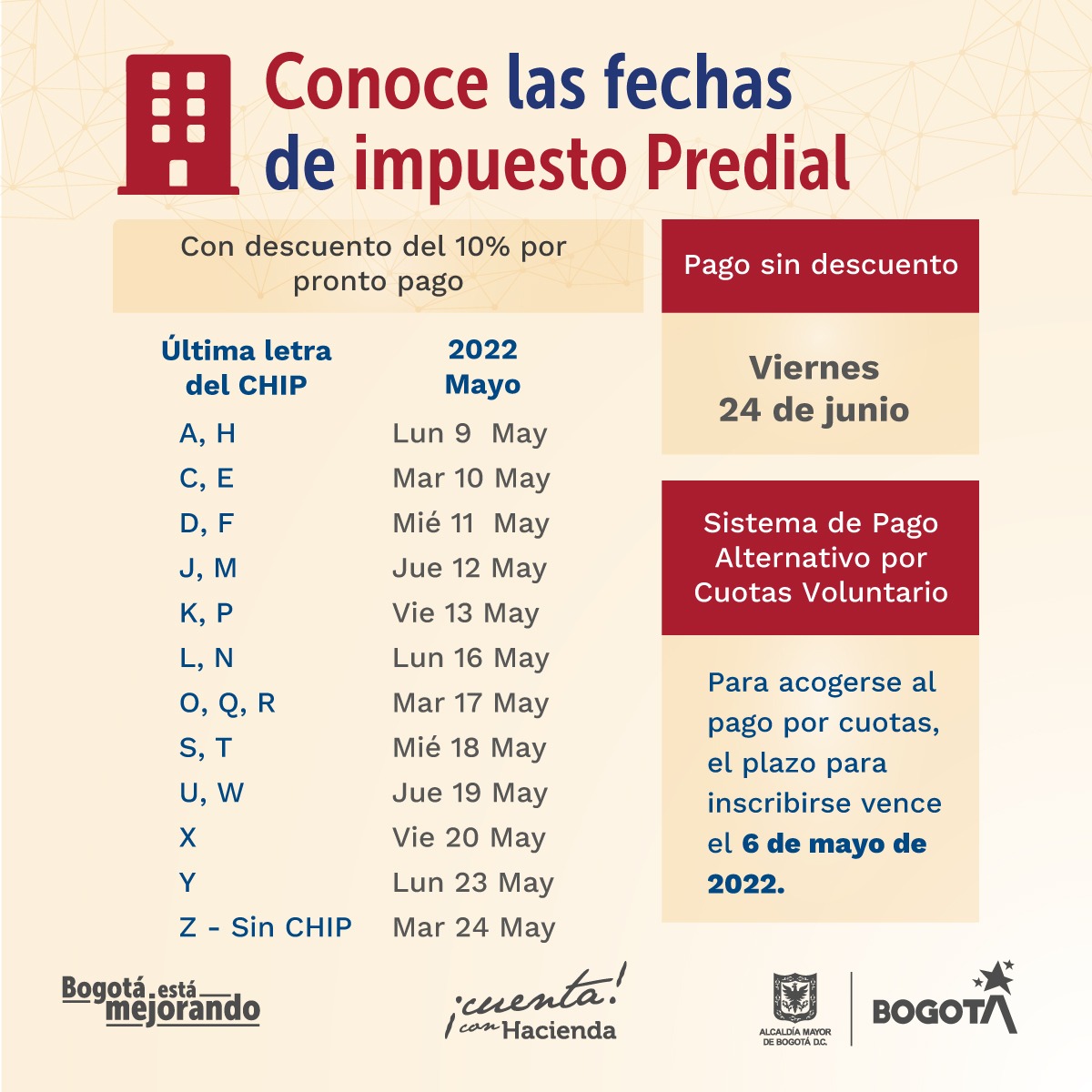

For this year, taxpayers will have until June 24 to comply with the obligation. However, if the Bogotá is interested in making the payment with the 10% discount, they must cancel it between May 9 and 24.

According to the Secretariat, these are the payment dates of the 10% discount obligation for prompt payment, which are determined by the last letter of the CHIP.

KEEP READING:

Últimas Noticias

Debanhi Escobar: they secured the motel where she was found lifeless in a cistern

Members of the Specialized Prosecutor's Office in Nuevo León secured the Nueva Castilla Motel as part of the investigations into the case

The oldest person in the world died at the age of 119

Kane Tanaka lived in Japan. She was born six months earlier than George Orwell, the same year that the Wright brothers first flew, and Marie Curie became the first woman to win a Nobel Prize

Macabre find in CDMX: they left a body bagged and tied in a taxi

The body was left in the back seats of the car. It was covered with black bags and tied with industrial tape

The eagles of America will face Manchester City in a duel of legends. Here are the details

The top Mexican football champion will play a match with Pep Guardiola's squad in the Lone Star Cup

Why is it good to bring dogs out to know the world when they are puppies

A so-called protection against the spread of diseases threatens the integral development of dogs