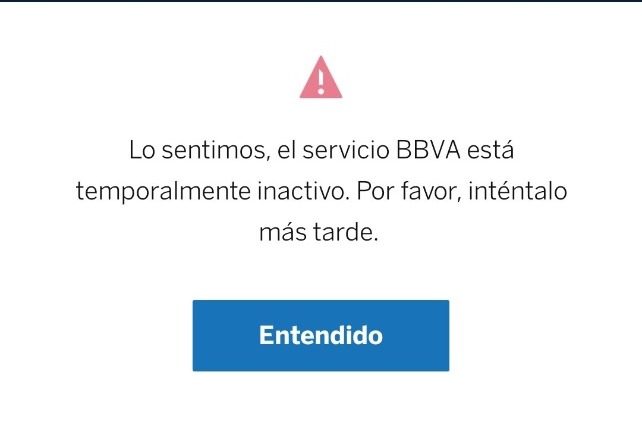

With the caption “Sorry, the BBVA service is temporarily inactive. Please try again” on the screen, users reported the drop in service of the BBVA Mexico bank application at approximately 1 pm this Friday. Which caused the annoyance of thousands of users on Twitter.

“BBVA Mexico informs all its users that we are experiencing intermittencies in our services. We are working to solve it as soon as possible and to carry out the operations that our users require. We apologize for the inconvenience caused,” the bank reported in a statement on its social networks.

Users reported that this is not the first time this has happened in the year and that it is also recurrent that this happens when it is fortnight and they have to make significant payments. Operators of the banking institution replied to some of the messages stating that they were working on the situation and invited users to try to enter the application within the day.

The bank announced in 2021 that around 15.1 million digital customers were registered, representing a growth of 31.8 percent compared to the previous year due to the health crisis. But since last year there have been various intermittencies in systems, especially in the mobile application.

The last drop was barely nearly a month on February 28, when users of the BBVA app reported a similar drop on Twitter. Several of the netizens claimed that they thought their cards had been cloned, as “Information not available. We are unable to display your information at this time. Try again” was the legend that was presented in the application; but thanks to social networks they knew it was again a failure of the bank.

The application reads “At BBVA we are improving for you, growing and integrating innovative services into our infrastructure that will improve your experience in our BBVA Mexico app. Due to this maintenance process, the service is not available. We will restore operation as soon as possible. Thank you for your understanding!

Despite the fact that most of the tweets about the event are annoying by users who use this bank, you can find various memes of some who took the fall of the institution with humor.

According to the DownDetector platform, 66 percent complained about failures in the Mobile Banking service, while 29 percent reported failures related to Online Banking and 7 percent with deposits in general. In addition to the fact that the interruptions began around 12:20pm, reaching the highest point at 1 pm. The most affected cities are known to be Guadalajara, Mexico City, Monterrey and Tijuana.

At the end of last year Eduardo Osuna, director of BBVA Mexico, explained the recurring failures in his service and stated that: “There are some issues that have to do with an excess of transactionality that can happen at any time, it is almost always predictable in the fortnight, on a bridge, you make estimates of transactionality, you prepare your entire infrastructure to withstand 50 to 70 million transactions. But if at any point there is any degradation of any platform that can degrade the service. Normally what we do is that if it's not a major failure, that you have to lower the system, what we call intermittency happens.”

KEEP READING:

Últimas Noticias

Debanhi Escobar: they secured the motel where she was found lifeless in a cistern

Members of the Specialized Prosecutor's Office in Nuevo León secured the Nueva Castilla Motel as part of the investigations into the case

The oldest person in the world died at the age of 119

Kane Tanaka lived in Japan. She was born six months earlier than George Orwell, the same year that the Wright brothers first flew, and Marie Curie became the first woman to win a Nobel Prize

Macabre find in CDMX: they left a body bagged and tied in a taxi

The body was left in the back seats of the car. It was covered with black bags and tied with industrial tape

The eagles of America will face Manchester City in a duel of legends. Here are the details

The top Mexican football champion will play a match with Pep Guardiola's squad in the Lone Star Cup

Why is it good to bring dogs out to know the world when they are puppies

A so-called protection against the spread of diseases threatens the integral development of dogs