A report prepared by the Audit Commission of the Congress of Ecuador revealed the millionaires damages to the country that it meant paying loans to China with very low price Ecuadorian oil. According to the document that will be discussed later this Wednesday, the possible damage to the Ecuadorian State amounts to USD 4,771,612,800.

Lines of credit with China were Ecuador's main form of financing during the administration of former President Rafael Correa, who ruled the country for 10 years, since 2007. According to the commission, between 2009 and 2016, Ecuador received loans of USD 18.47 billion. Interest exceeded 7%, not including financial costs, these interest rates exceed those used by credit multilaterals, such as the International Monetary Fund (IMF). To repay these loans, the country committed, until 2024, to the delivery of 1,325 million barrels of crude oil to the Asian companies Petrochina International Company Limited, Unipec Asia Co Limited and PTT International Trading Pte. Ltd. “The agreed volume shows that five times more oil was committed than was required to cover the debt,” the report reads.

The big problem with the debt of Ecuador and China is that the barrels of oil that were given as a form of payment were not valued against the international price of crude oil but that the price per barrel was frozen, this would have caused significant damage to Ecuador, since for each barrel, the country lost around USD 3.60. So far, the Andean country has delivered 1,174 million barrels as a form of payment.

According to information provided by Petroecuador to the legislator and chairman of the supervisory commission, Fernando Villavicencio, 87 per cent of Ecuadorian crude oil is destined for the performance of contracts with Asian companies, “under a formula that generates a lower price than the market price, directly affects the “SPOT” spreads of Oriente and Napo, generating a preference in the regional market to buy this same Ecuadorian crude at a lower cost than it should really cost.” According to the legislative committee's report, which is more than 200 pages long, Ecuador stopped receiving around USD 4.234 million from trading crude oil.

The barrels of oil with which Ecuador covered its debt to China were endorsed to banks and private companies to be resold at the international market price. At the center of the “largest oil corruption plot in Ecuador”, as Villavicencio has described it, would be the company Gunvor. Raymond Kohut worked in that multinational, who in December 2021, confessed to the US courts to the payment of at least USD 70 million in bribes to Petroecuador officials and in payment of commissions to other intermediaries. Kohut and its corporate activities were exposed thanks to the Pandora Papers research.

Gunvor “helped to obtain financing of approximately USD 5.4 billion in oil-backed loans” with a view to “obtaining and retaining” businesses in Petroecuador, says the US tax prosecution, according to the report. In addition, the legislators of the Audit Commission explain that “the aforementioned “agreements” were nothing other than simulated contracts that grossly enabled Ecuador's excessive indebtedness”.

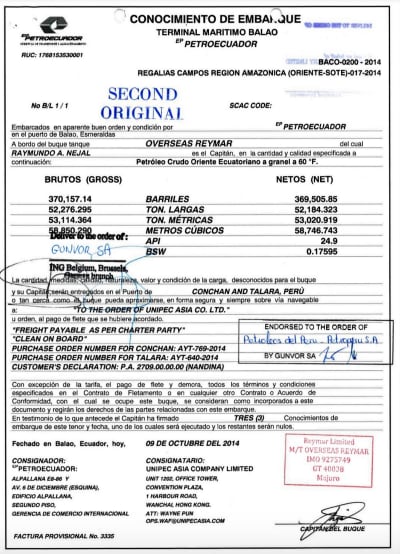

The endorsements of the bills of lading delivered by Petroecuador to the Audit Commission revealed that Ecuadorian crude oil, consigned to Asian companies Petrochina, Unipec and PTT as debt payments, was marketed by European banks ING, Geneva branch, Natixis in Paris, Credit Agricole in Switzerland and Société Générale of France, as well as the Russian-owned multinational, Gunvor, through Gunvor S.A. and the companies Core Petroleum, Castor Petroleum and Taurus Petroleum. These companies, the Commission explains, have been “identified as the final sellers of our oil in Peru and elsewhere”.

The text of the report to be discussed in the Legislative Commission recommends that the information be forwarded to the Office of the Attorney General of the State of Ecuador to investigate the alleged commission of crimes. They also request that the report be brought to the attention of the Peruvian Public Prosecutor's Office and that the present report be sent to the New York State Court which is conducting the judicial proceedings against Raymond Kohut, a former employee of the Gunvor company, and that the Ecuadorian Prosecutor's Office, through international criminal assistance, request the statements and evidence of the Kohut and Aguilar case in the New York court.

KEEP READING:

Últimas Noticias

Debanhi Escobar: they secured the motel where she was found lifeless in a cistern

Members of the Specialized Prosecutor's Office in Nuevo León secured the Nueva Castilla Motel as part of the investigations into the case

The oldest person in the world died at the age of 119

Kane Tanaka lived in Japan. She was born six months earlier than George Orwell, the same year that the Wright brothers first flew, and Marie Curie became the first woman to win a Nobel Prize

Macabre find in CDMX: they left a body bagged and tied in a taxi

The body was left in the back seats of the car. It was covered with black bags and tied with industrial tape

The eagles of America will face Manchester City in a duel of legends. Here are the details

The top Mexican football champion will play a match with Pep Guardiola's squad in the Lone Star Cup

Why is it good to bring dogs out to know the world when they are puppies

A so-called protection against the spread of diseases threatens the integral development of dogs