For the third consecutive week, the Excise Tax on Production and Services (IEPS) for fuels will remain at 100% until the first day of April, the Government of Mexico reported through the Ministry of Finance, as a way to maintain the cost of gasoline in the face of rising prices in the international market.

The conflict between Russia and Ukraine has mainly affected the prices of raw materials and energy products, which can be reflected in high oil prices and international prices.

In this way, the collection of the IEPS for regular gasoline, premium gasoline and diesel has been eliminated, as a fiscal stimulus by the federal government so as not to affect the consumer economy, a measure that has been taken since the beginning of March on a consecutive basis.

However, according to a study by BBVA Research, if there is a 33.3% increase in international gasoline prices would have a negative impact on the collection by IEPS of gasoline and diesel of -72.8% at a quarterly rate.

Meanwhile, gasoline prices for this Monday, March 28 in Mexico, according to figures from the Energy Regulatory Commission, are as follows:

Regular gasoline (magna): 21.35 pesos per liter.

Premium gasoline: 23.33 pesos per litre.

Diesel: 22.83 pesos per litre.

However, it should be remembered that prices may vary according to the reference cost (which is based on international oil prices and is quoted in dollars globally), taxes and logistics, such as transport and storage.

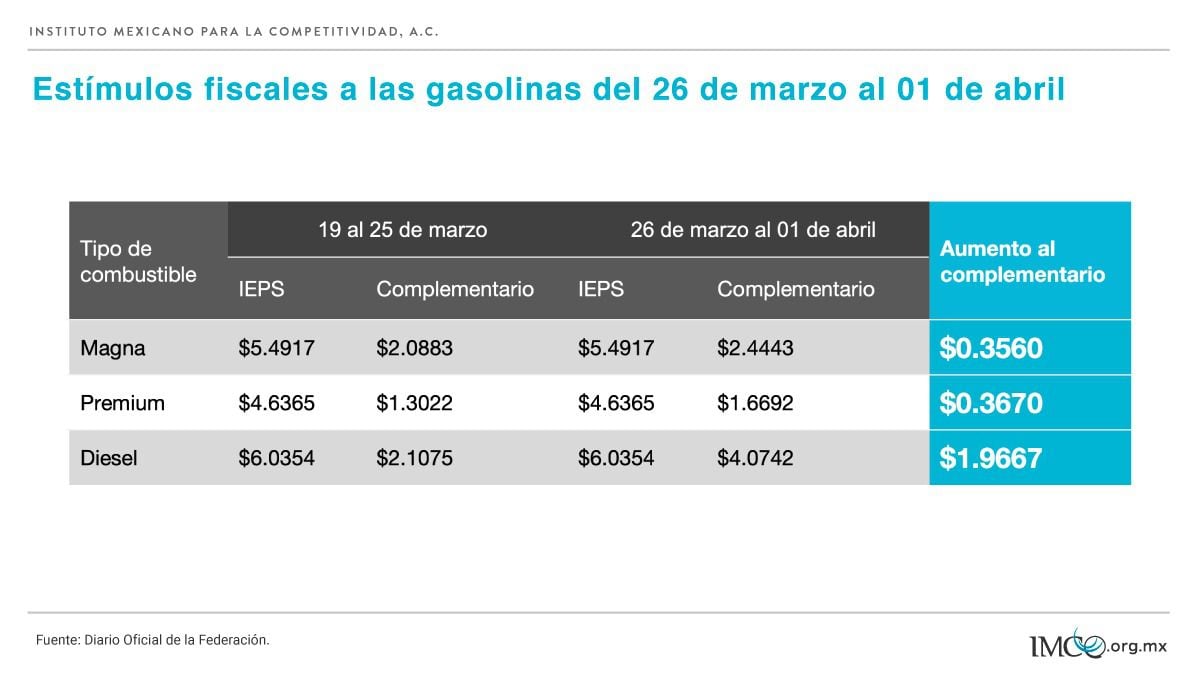

In this way, Mexican motorists would save about 5.49 pesos per liter for regular gasoline; 4.63 pesos for Premium and about 6.03 pesos per liter of diesel.

Likewise, the Ministry of Finance slightly increased the additional fiscal stimulus from March 26 to April 1, so that a supplementary amount of 2.44 pesos will be provided for magna gasoline, while for premium and diesel it will be 1.66 and 4.07 pesos respectively.

In this sense, the total incentives granted by the federal government are as follows: for the magna it is 7.93 pesos, for the premium it is 6.30 pesos and for diesel it is 10.10 pesos.

According to a study carried out by the Mexican Institute for Competitiveness (IMCO), the Ministry of Finance could lose more than 200 billion pesos in the rest of the year due to losses lost from the IEPS collection.

Should the Mexican blend maintain a linear behavior until the end of 2022, with an annual average of $70 per barrel, public finances could lose about 119.3 billion pesos.

However, at his morning conference on March 28, President Andrés Manuel López Obrador indicated that the Mexican oil mixture was $110 per barrel. Under this scenario, IMCO warned that losses would be 205.5 billion pesos.

Finally, IMCO noted that “as a result of oil price pressures at the current juncture, public finances in Mexico will be affected in two ways.” On the one hand, the revenue from IEPS would be reduced to stabilize the price of gasoline and, on the other, oil revenues derived from the Mexican Export Blend (MME) would increase.

KEEP READING:

Últimas Noticias

Debanhi Escobar: they secured the motel where she was found lifeless in a cistern

The oldest person in the world died at the age of 119

Macabre find in CDMX: they left a body bagged and tied in a taxi

The eagles of America will face Manchester City in a duel of legends. Here are the details

Why is it good to bring dogs out to know the world when they are puppies