Do you have your own business, are you freelance or do you work on your own? Then this information might interest you, because the Mexican Social Security Institute (IMSS) recalled the benefits of joining to receive various benefits.

The fact is that the IMSS has a new simplified comprehensive Social Security scheme for the voluntary incorporation of this sector of the population into the Compulsory Scheme.

By voluntarily registering with the institute, they will have the right to care in clinics, medicines and emergency departments, in addition to being able to enroll their beneficiaries.

How much do I have to pay? This is another question that they frequently ask, so the institute emphasized that those who want to join independently will pay in relation to their salary.

Thus, the IMSS explained that the payment will depend on the monthly income received.

In order to determine the cost of voluntary incorporation of self-employed persons, the IMSS provided them with a quota simulator, in which they will be able to calculate the amount for employers 'contributions, which will be payable according to the occupation they perform and the days of the insurance month.

How does the calculator work?

*Interested parties should go to the following link. Here.

*Place your occupation.

*Note the geographical area, that is, where your domicile is located.

*Finally share your income. Then the calculator will do its job and release the estimated amount.

In this regard, if you want to join the IMSS, you must take into account the following procedure.

How to do the procedure?

*The interested party will be able to access the following link. Here

*Then click on the “start procedure” section.

*Write down your CURP, RFC, Social Security Number (NSS) and an email.

*According to the IMSS, the last steps will be to click on continue, confirm the procedure and access your capture line.

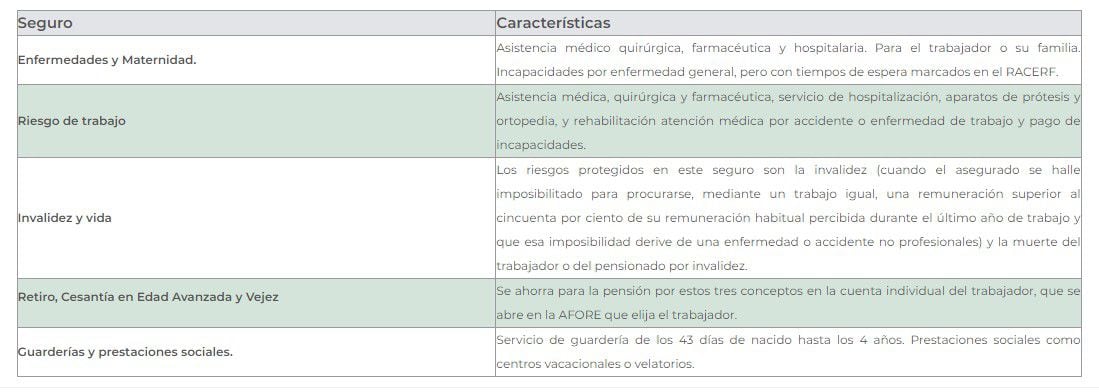

Under the new scheme, self-employed workers will be able to access the 5 insurance policies included in the Social Security Act. Although it is important to note that there are benefits in which various requirements must be met, like any other worker.

These are insurance such as: sickness and maternity, risk of work, disability and life, retirement, unemployment in old age and old age, as well as nurseries and social benefits. The following table shows the details and characteristics of the insurance.

It will be important to remember that, in addition to the insured independent worker, medical, hospital and pharmaceutical care is provided by its legal beneficiaries, such as:

-Wife or husband.

-Or in your case, your concubine or concubinary.

-Children up to 16 years old and up to 25 if they study.

-Father and mother, if they live with the worker and depend financially on him or her.

It should be remembered that there is currently no app for the affiliation process, but you can perform the steps mentioned above on the IMSS page.

It will also be necessary to detail that, this new scheme is an opportunity for anyone who carries out their activities on their own and to have better protection in the midst of this COVID-19 pandemic, which continues to diminish the lives of millions.

KEEP READING

Últimas Noticias

Debanhi Escobar: they secured the motel where she was found lifeless in a cistern

The oldest person in the world died at the age of 119

Macabre find in CDMX: they left a body bagged and tied in a taxi

The eagles of America will face Manchester City in a duel of legends. Here are the details

Why is it good to bring dogs out to know the world when they are puppies