Several real estate companies created at the end of the year the Registry of Real Estate Operations (ROI), an initiative that emerged to solve one of the segment's historic shortcomings: the lack of closing prices for agreements.

From the latest analysis through this tool, it was possible to determine that there was a real sincerity of property prices with respect to pre-pandemic values. The drop was on average 25% between 2019 and the present, for all neighborhoods.

“We do not currently have closing prices for 2018 but we dare say that the drop compared to that year was even greater. This point is important given that a good part of the existing offer seems to have as a reference those values that are not validated in the market today,” Fabián Achával, owner of the real estate company of the same name, told Infobae.

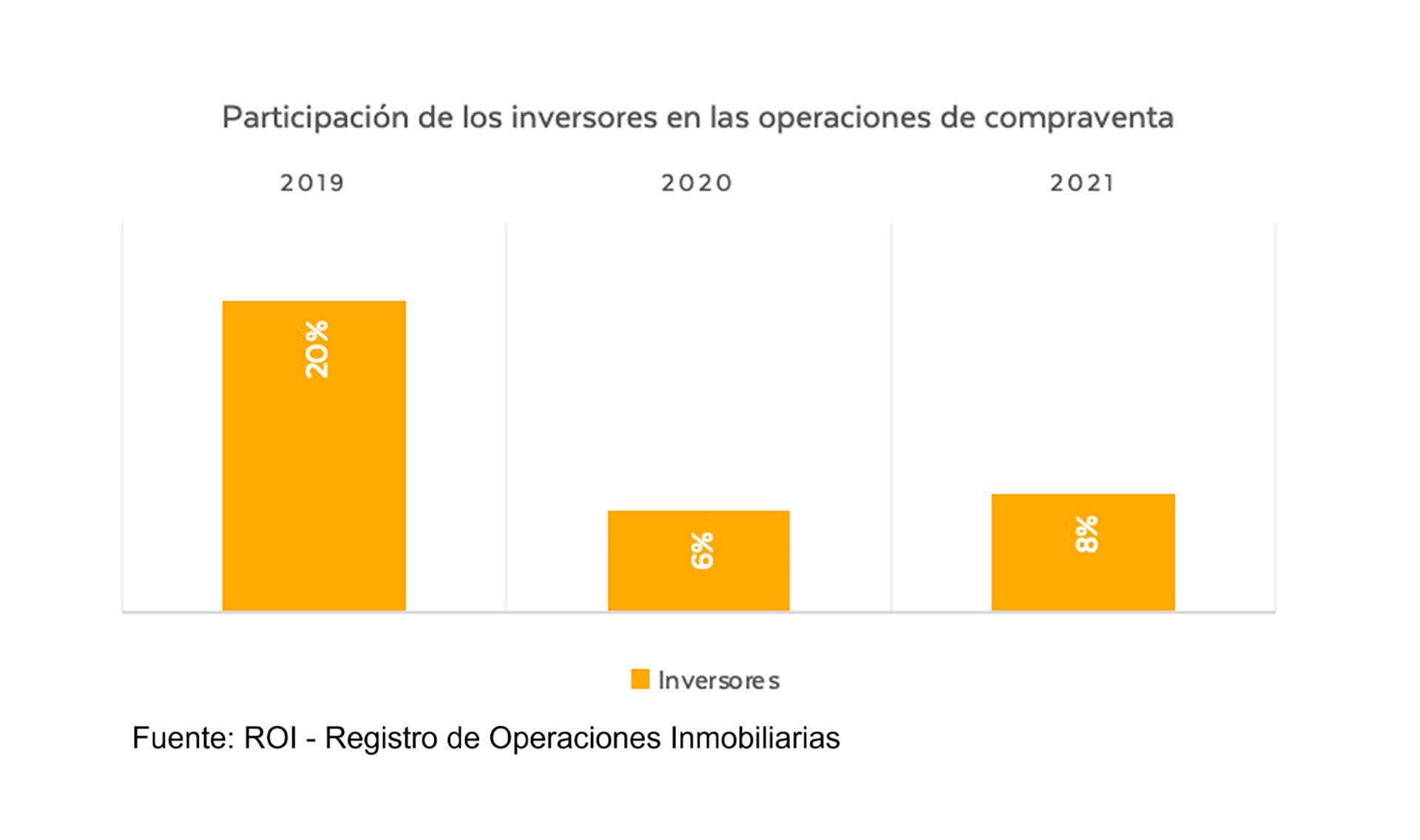

Another important fact is that investors practically disappeared as buyers. Currently, 92% of operations are carried out by end users.

Achával, pointed out that “this dynamic has to do with the loss of rent profitability in recent years and the disincentive produced by the Rent Law to which real estate revaluation and the possible project of a tax on empty properties recently added.”

How does the platform work: advantages and disadvantages

ROI is a platform that allows you to have real-time closing prices for transactions with real estate agencies with experience in the market.

“The benefit of having this information is very clear when it comes to assessing properties seriously. Currently, the gap that exists between publication values and closing prices is very large and therefore not having this information leads to a loss of time and money for the seller,” Achával added.

Experts argue that it is important not to generate false expectations from customers about the value of their property and ROI helps to avoid them.

Iuri Izrastzoff of Izrastzoff Real Estate, told Infobae that on the other hand it is a central tool for closing deals given that the potential buyer often makes very aggressive offers. “Having surveys allows us to raise their initial offer with greater confidence since we can show them real market values,” he said.

Palermo and Las Cañitas are the porteño routes that maintained their values. In the latter case it is an area of a few blocks, with few operations but which has retained the value of the square meter more. Palermo, being the largest neighborhood, has much more variability in results, but on average it maintains its values more than areas such as Belgrano or Recoleta.

According to Zonaprop, in Palermo, the average value of the m2 in used apartments is USD 3,195 and brand new at 3,428 dollars. In Belgrano, it is USD 2,986 in used and USD 3,486 for brand new.

Soledad Balayan, from Maure Inmobiliaria, pointed out to Infobae that demand that mobilizes savings in operations “privileges buildings to be of great brightness, with balconies with some particular view and recycled apartments with modern comfort. These types of units maintain their closing values more. We also noticed that most sales are from units at the front.”

Experts consulted agreed that the market knows how to read measures that have short- and long-term effects, including waiting for the endorsement of the International Monetary Fund (IMF) of the agreement with the Government to refinance the debt.

“This would be a beneficial short-term measure, but without a consistent long-term economic plan, the investor will not make any substantial changes in their decisions,” Balayan said.

The market had largely discounted an agreement with the IMF and therefore no major changes were expected.

Achával said that “this is still good news given that we have a clear financial program to repay the debt for the next 3 years. This, together with the USD 5 billion that the IMF would allocate to strengthen the Central Bank's net reserves, puts us in a better position to overcome the shortage of foreign exchange we have been experiencing in recent years.”

The sector continues to demand that it is vital that a mortgage loan scheme be generated to be able to buy one's own home, but that without a strong currency and consolidated real wage it will be difficult for a credit scheme to be structured.

Another central issue is to achieve greater transparency of benchmarks in the market. Both buyers and sellers do not know the price at which the trades take place.

“We believe that until there is a change in political sign, we will not see a change in trend, although expectations can help to boost the market, as happened in 2015, when the number of writings made grew due to the certain change of orientation that was perceived when candidates Daniel Scioli, Mauricio Macri grew. and Sergio Massa were seen as more moderate,” Izrastzoff stressed.

In the market, the supply of real estate is at record levels. The agenda to improve the situation is very varied, from macroeconomic factors to greater legal certainty for owners.

“Today we are faced with an explosive cocktail of low rental profitability that is at historic lows (aggravated by higher taxes) and legal uncertainty regarding contracts (duration, update),” Achával concluded.

KEEP READING:

Últimas Noticias

Debanhi Escobar: they secured the motel where she was found lifeless in a cistern

The oldest person in the world died at the age of 119

Macabre find in CDMX: they left a body bagged and tied in a taxi

The eagles of America will face Manchester City in a duel of legends. Here are the details

Why is it good to bring dogs out to know the world when they are puppies