A long chain of linked factors since September 2021 caused inflation to rise in early 2022, as explained by the Central Bank in its Monetary Policy Report (IPOM), a report that the entity publishes twice a year to explain its vision of the economic situation and its projections. The BCRA's argument makes explicit the multicausal nature of inflation, in line with the agreement with the IMF. However, in the report the Central Bank also admitted that it is preparing for the usual prescriptions: raising rates and reducing emissions.

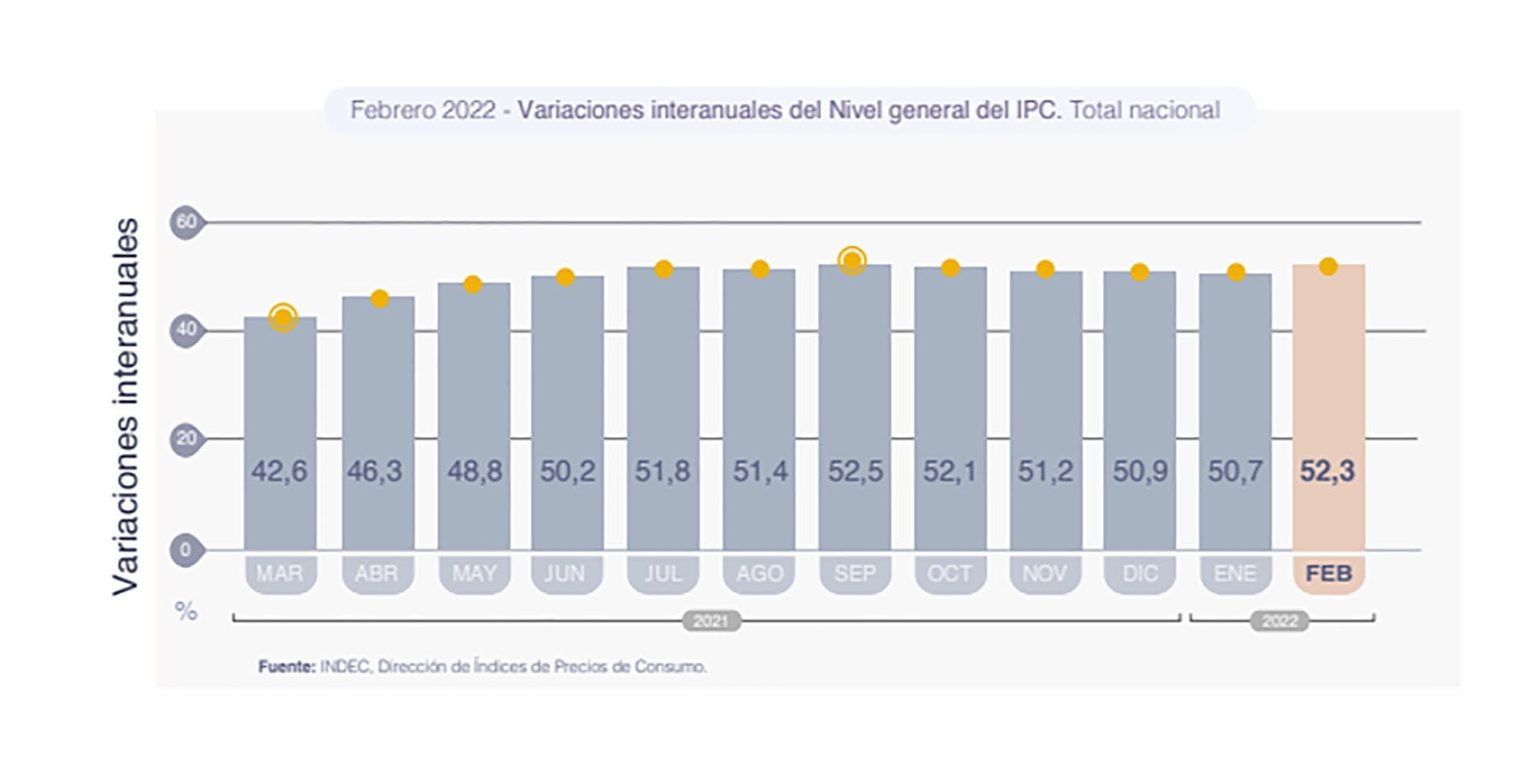

The BCRA pointed out that average monthly inflation for the fourth quarter of 2021 was 3.3%, while in the first two months of this year it jumped to 4.3%. The increase in inflation, he added, began in the context of the post-pandemic economic recovery: “The greatest dynamism in prices since September 2021 was seen in the context of the recomposition of the marketing margins of certain sectors, the reopening of wage parities and higher inflation expectations such as as a result of the increased exchange rate pressures typically associated with electoral processes”.

For the Central, in this pre-election stage “the private sector tends to accentuate its pattern of financial dollarization, to which was added the financial uncertainty generated by entering a stage of defining negotiations with the IMF for a new debt agreement with the agency”.

To complete his diagnosis of the price increase, he concluded: “In addition to the scenario of high inflationary inertia, unfavorable domestic climatic conditions and the significant increase in international prices of agricultural raw materials, energy and global manufactures have been added since January, which presented a significant increase in global agricultural raw materials, energy and manufactures. acceleration in the face of the conflict between Russia and Ukraine, which poses a challenging scenario, especially for the next two months.”

Beyond this description to explain the rise in prices, the IPOM details the way forward to combat it: raising the interest rate, accumulating reserves and reducing financial assistance to the Treasury, aspects included in the agreement with the International Monetary Fund.

On the first point, the report highlighted that “the increase in the monetary policy interest rate seeks to tend towards positive real returns on investments in local currency, in order to boost demand for pesos. That is why, for the future, developments in inflationary matters will be reflected in the calibration of interest rates by the monetary authority.”

Thus, the BCRA anticipates that it will raise the benchmark rates again, as it did in January (from 38 to 40%) and in February (from 40 to 42.5 per cent), in the search for savers to be able to cover their pesos against inflation. The acceleration of the CPI will force it to make the increases stronger than they were until now if they want to meet that goal.

With regard to the accumulation of reserves, he considered it “a necessary condition for reducing levels of inflationary inertia” that will help to dispel “the risks of balance-of-payments crises and abrupt exchange rate jumps, thereby anchoring exchange rate expectations”.

“In order to strengthen the position of international reserves, the rate of depreciation was changed to gradually bring it to levels more compatible with the domestic inflation rate,” the report added to explain the process that has been taking place since the end of last year: the official dollar rising at the rate of the CPI. For most of 2021, the devaluation of the peso was lower than the inflation rate.

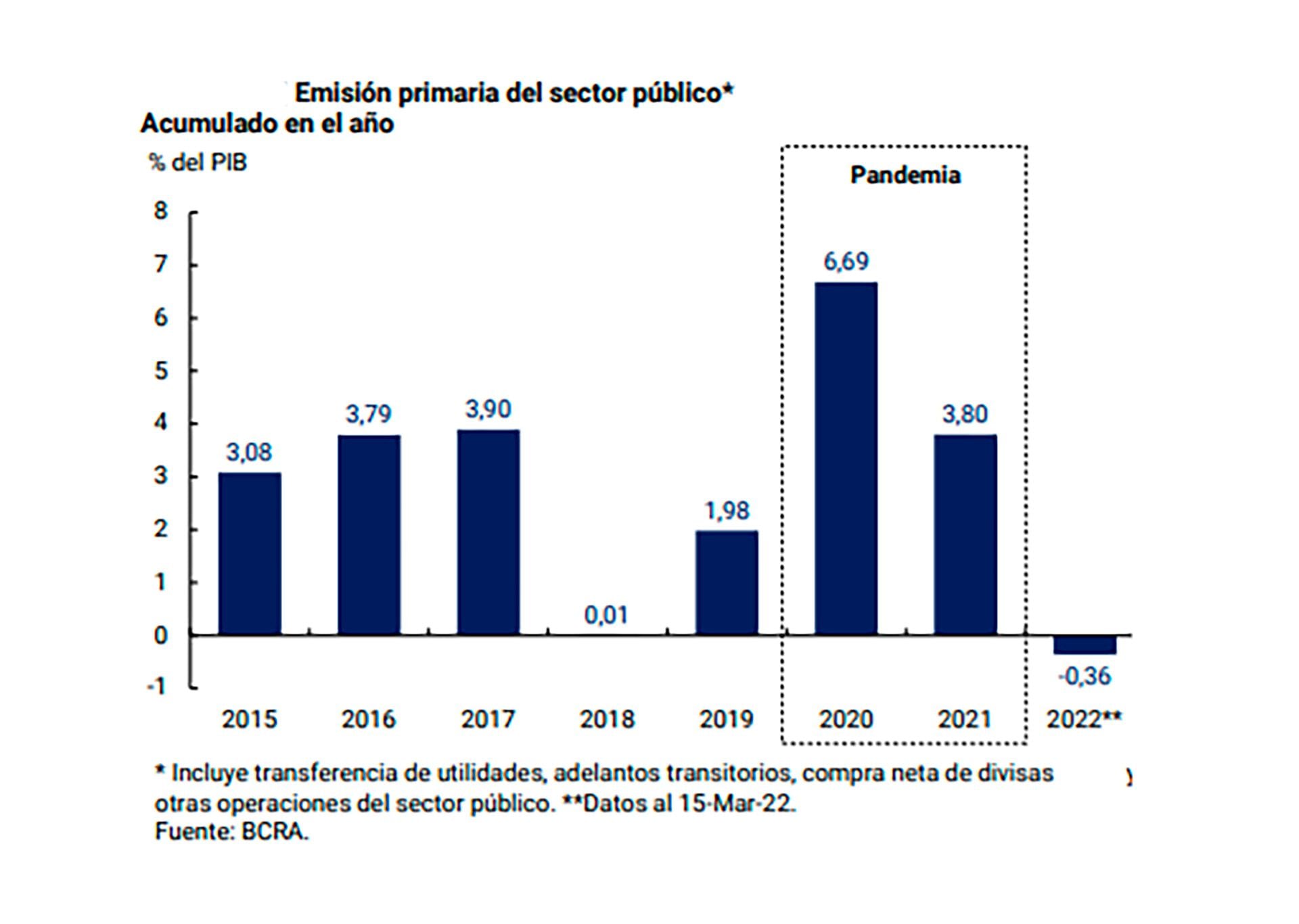

The Central Bank also highlighted in its report that the primary expansion of the public sector in 2021 was “significantly lower” than in 2020 and that it continued to absorb liquidity through its regulatory instruments, passes and Leliq. “The Monetary Base ended the year with a 40% expansion, which meant a contraction in real terms, and the balance of remunerated liabilities stood at around 9.7% of GDP.”

On the concern that countries and Leliq will grow to risky levels, noted by many analysts, the IPOM anticipates a reduction: “Given the projected growth in monetary-based demand, it is estimated that, for every 1 p.p. increase in monetary policy interest rates, paid liabilities would increase by 0.07 p.p. of GDP. Even considering this effect, in a context of reduced sterilization needs, during 2022 remunerated liabilities will be reduced in relation to GDP.”

“It is expected that the monetary sterilization effort will be reduced. This will favor money-based demand to be provided by interest associated with BCRA's remunerated liabilities and, potentially, by a reduction in its stock,” the report added.

The Central Bank considers that the causes that raised inflation were “transitory” and that the decline in indices will come thanks to the stability of the dollar and the rise in rates: “It is expected that the transitional factors that pressed the general price level will subside and that inflation will resume a path of gradual slowdown and sustained. The stabilization of the real exchange rate at its current level, which preserves the external competitiveness of the economy, and the calibration of interest rates to reflect inflationary developments in order to ensure a positive return on investment in local currency, will help to stabilize expectations, favoring the process of disinflation.”

It was also noted that the issuance of the BCRA in favor of the Treasury, made feasible through profit sharing and transitional advances, will be lower than in the past: “After two years in which the Central Bank exceptionally assisted the Treasury to meet the needs arising from dealing with the pandemic, without access to the external financing and with a domestic capital market under reconstruction, the progress achieved by the National Government in normalizing the peso debt market and the prospects for external financing by multilateral and bilateral agencies pose a scenario with a significant reduction in aid financial assistance to the Treasury”.

KEEP READING:

Últimas Noticias

Debanhi Escobar: they secured the motel where she was found lifeless in a cistern

Members of the Specialized Prosecutor's Office in Nuevo León secured the Nueva Castilla Motel as part of the investigations into the case

The oldest person in the world died at the age of 119

Kane Tanaka lived in Japan. She was born six months earlier than George Orwell, the same year that the Wright brothers first flew, and Marie Curie became the first woman to win a Nobel Prize

Macabre find in CDMX: they left a body bagged and tied in a taxi

The body was left in the back seats of the car. It was covered with black bags and tied with industrial tape

The eagles of America will face Manchester City in a duel of legends. Here are the details

The top Mexican football champion will play a match with Pep Guardiola's squad in the Lone Star Cup

Why is it good to bring dogs out to know the world when they are puppies

A so-called protection against the spread of diseases threatens the integral development of dogs