Self-employed workers may be required to pay the Income Tax even if they are close to the poverty line. According to a work by the private consultancy firm Focus Market, they suffer a “tax inequity” vis-à-vis mono-taxpayers and salaried workers.

“Both deputies, government officials and the opposition, promised after the opening of the sessions of the Congress of the Nation in March 2021 that they would update the scales of tax payments for self-employed workers. Nothing has been done and a year has passed. They then insisted with that same promise in campaigning for the national legislative elections. The self-employed are poor and at risk with this tax burden. At the opening of this year's Congress sessions, the President did not even mention the situation of the poverty limit that this tax regime is going through for the payment of earnings,” said Damián Di Pace, director of the Focus Market Consultancy.

The consultant's report shows four cases:

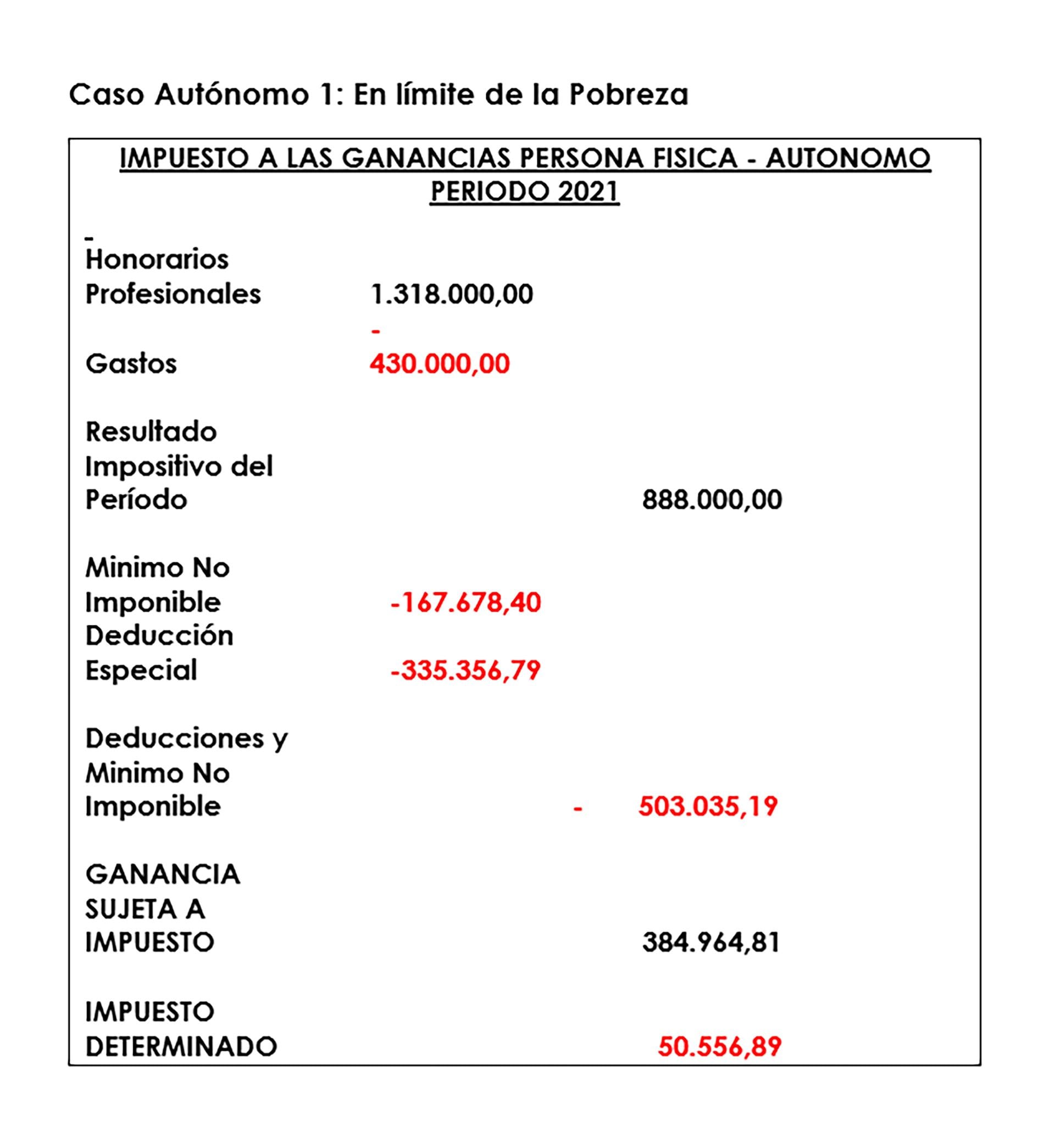

- A self-employed worker who charged $74,000 per month for professional fees (difference between fees and expenses). This value is called the “Tax Result”, from which — after deductions — the annual tax will be determined. In the event that this professional supports a typical family according to the latest data from Indec, the Total Basic Basket (CBT) is $83,807. This self-employed worker does not meet basic needs and is 13% below that threshold ($9,807 below the poverty line).

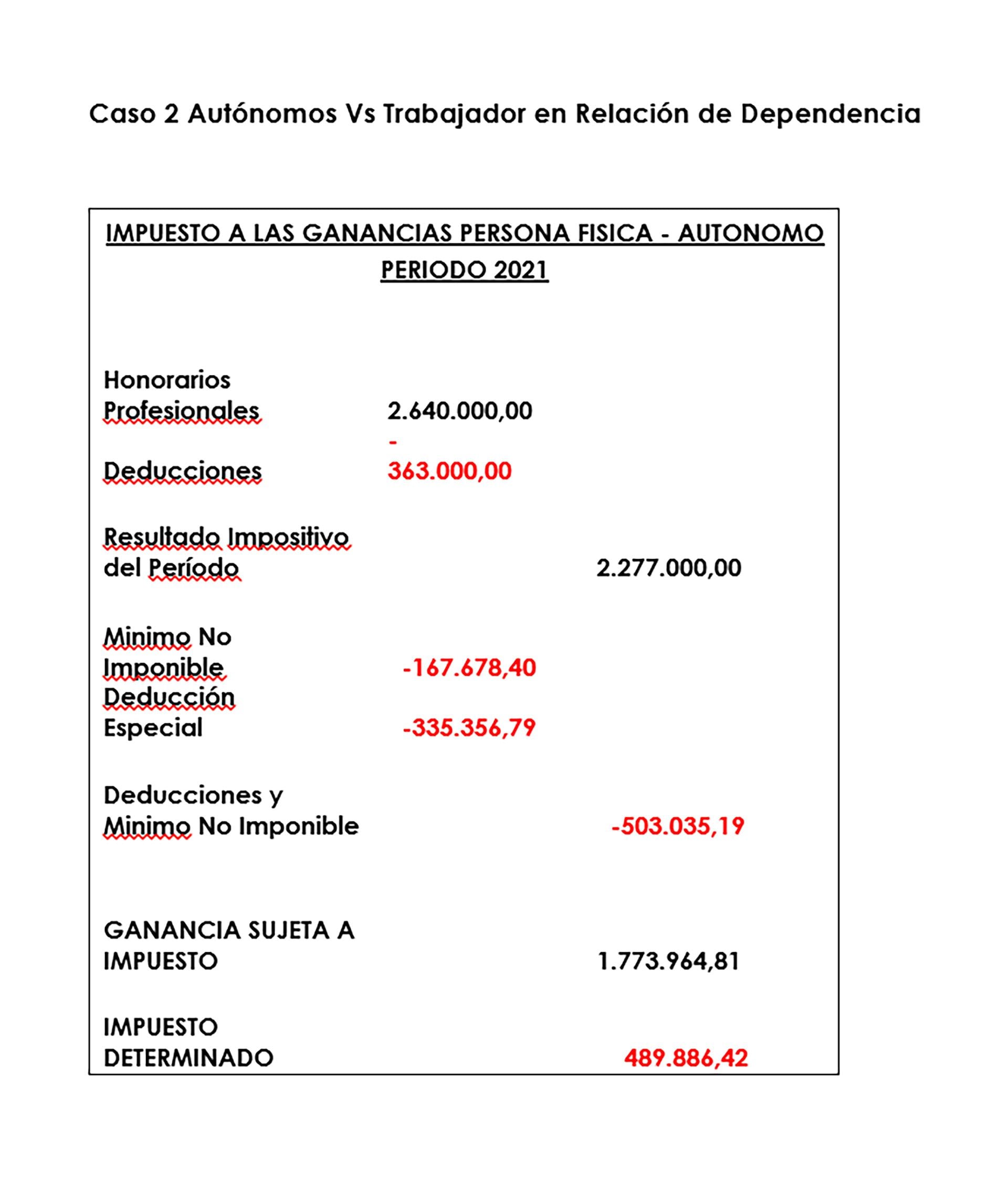

- If we compare the situation of a self-employed person and a worker in relation to dependency who earn $225,000 per month ($2,640,000 a year) for the same income they have a differential tax treatment. “Faced with the same level of income, the person in relation to dependency is in a more favorable position when it comes to paying taxes. In 2021, a self-employed person began to pay Income Tax starting at $64,532 and that same year it was legislated for a worker in a dependent relationship to start paying from $225,000 per month,” the report noted.

- When comparing a monotaxist versus a self-employed person in their different formats (director of company, professional, among others) who receive annual income of $3,200,000, a company director will contribute a fixed monthly tax of $22,968.62, in addition to Income Tax, Gross Income Tax, VAT. At the same income level, the monotaxpayer will pay $16,114 and the self-employed director of society $22,968 plus 35% Income Tax, 21% VAT, 3% Gross Revenue plus other national or provincial taxes.

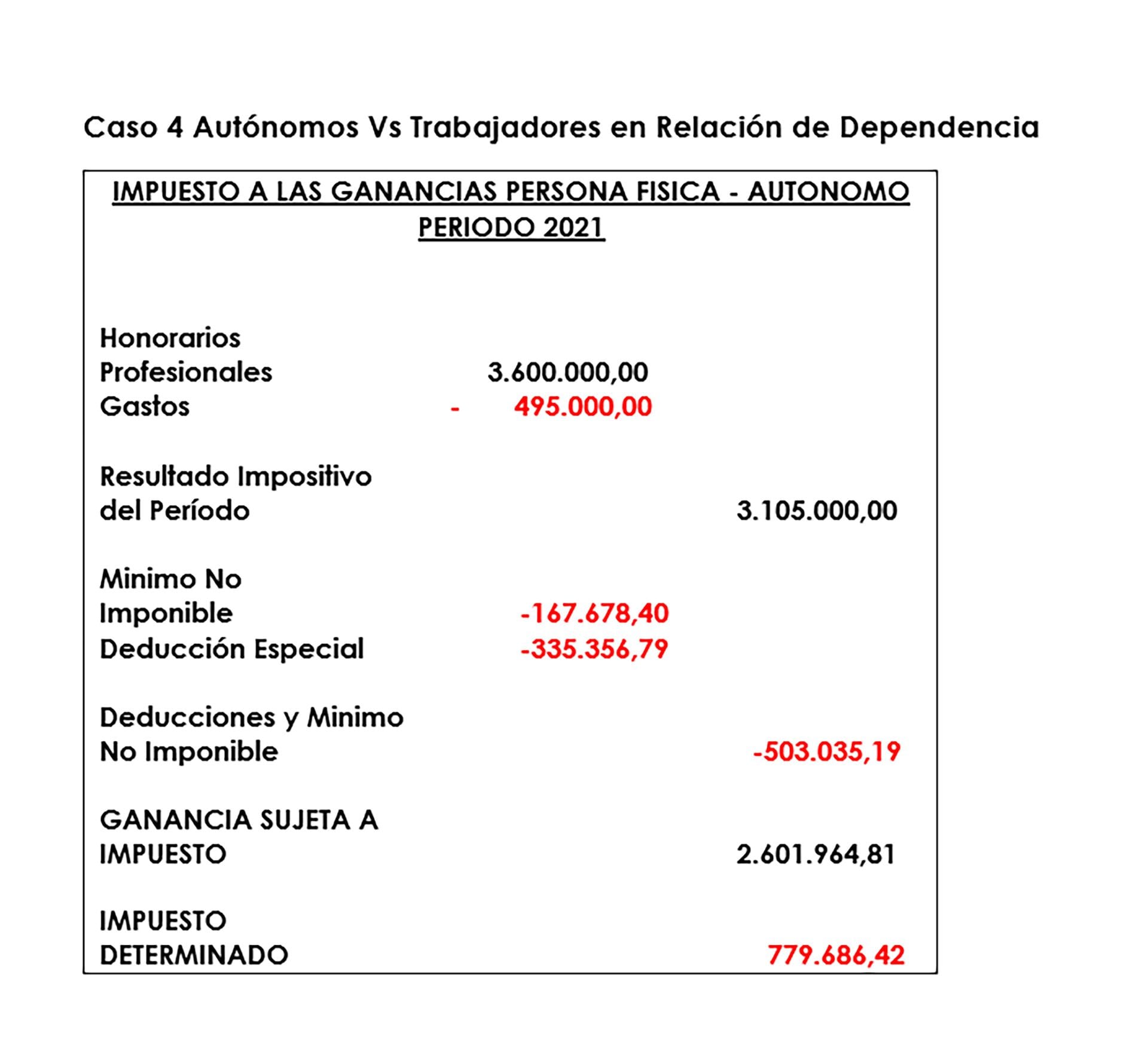

- In the case of a self-employed person who earns $300,000 per month ($3,600,000 per year), a tax of $779,686.42 will be taxed on the additional income per year, while a natural person in relation to dependency with an annual salary of $3,600,000 (including bonus) will be taxed $315,000. “This is another clear example of how tax treatment is not only distortive because higher incomes do not always reflect gains in real terms, but differentiated treatment for contributors encourages informality,” the report stressed.

“The self-employed regime is complicated and distortive. Withholding by income categories means that taxpayers have to be more creative in not falling for a minimum nominal increase in the next category with a much higher rate. For example, in the case of an annual income of $3.2 million of a monotaxpayer versus an income of $1 million of a self-employed person, the latter would pay 35% in Income Tax on the surplus,” said Di Pace.

KEEP READING:

Últimas Noticias

Debanhi Escobar: they secured the motel where she was found lifeless in a cistern

Members of the Specialized Prosecutor's Office in Nuevo León secured the Nueva Castilla Motel as part of the investigations into the case

The oldest person in the world died at the age of 119

Kane Tanaka lived in Japan. She was born six months earlier than George Orwell, the same year that the Wright brothers first flew, and Marie Curie became the first woman to win a Nobel Prize

Macabre find in CDMX: they left a body bagged and tied in a taxi

The body was left in the back seats of the car. It was covered with black bags and tied with industrial tape

The eagles of America will face Manchester City in a duel of legends. Here are the details

The top Mexican football champion will play a match with Pep Guardiola's squad in the Lone Star Cup

Why is it good to bring dogs out to know the world when they are puppies

A so-called protection against the spread of diseases threatens the integral development of dogs