The advance of the agreement between the Government and the International Monetary Fund (IMF), with a successful legislative process that must now be endorsed by the agency's board of directors, was not enough to calm devaluation expectations or improve the inflow of foreign exchange into the exchange market.

With cash deals in the wholesale market whose volume is not appreciably increasing, despite the beginning of the period of greatest liquidation of agricultural exports, the Central Bank is having difficulty making foreign exchange purchases to increase its stock of reserves.

Although in the first tranche of March the bank pocketed nearly USD 600 million for its interventions, in the last three business rounds it had to switch to the selling side, for a total of close to 100 million dollars.

On Monday, there was an improvement in the volume traded, by some USD 421.4 million in the spot segment, but the improvement in supply did not exempt Central from making sales of about USD 49 million, according to private estimates, after sales of about USD 15 million on Friday, 18, and a negative balance of about USD 33 million on Friday, the 18th, and a negative balance of about USD 33 million on Thursday 17. On Wednesday of last week, it had ended with a neutral balance, and on the previous Tuesday, with a positive marginal balance of half a million dollars.

Gustavo Quintana, agent of PR Corredores de Cambio, said that “BCRA ended the first round of the week with sales of USD 49 million to meet wholesale demand for foreign exchange.” In March, it still has a balance in favor of about 450 million, preceded by four months with a negative balance, between November and February.

The foreign exchange buying trend at the hands of the BCRA reversed last week, following the decision of the Ministry of Agriculture to temporarily close the exports of soybean meal and oil, before establishing an increase of two percentage points (from 31 to 33 per cent) for the withholdings on these products, which are the basis of Argentine exports.

After the approval of the agreement with the Fund in the upper house, the Board of the Fund will now vote on March 25 - as confirmed by the organization - on the agreement it signed with Argentina for the debt. Although March 22 is the expiry of a commitment to the IMF, the agency gave the Government the possibility to pay the next two maturities without falling into default.

The spokesperson for the multilateral organization, Gerry Rice, reported on the postponement of the expected maturities for 21 and 22 of this month by about 2,014 million Special Drawing Rights (SDRs) in total (equivalent to about USD 2.9 billion), which can be completed until March 31 without being considered in default; and confirms that the board will meet on 25 March to vote on the memorandum.

It should be remembered that the Central Bank's international reserves fell last week by about $25 million and ended at $37,013 million, which means that they are close to drilling the $37 billion floor for the first time since December 15, 2016 (USD 36,878 million).

In this regard, it should be emphasized that the BCRA does not have liquid dollars to honor this week's maturity.

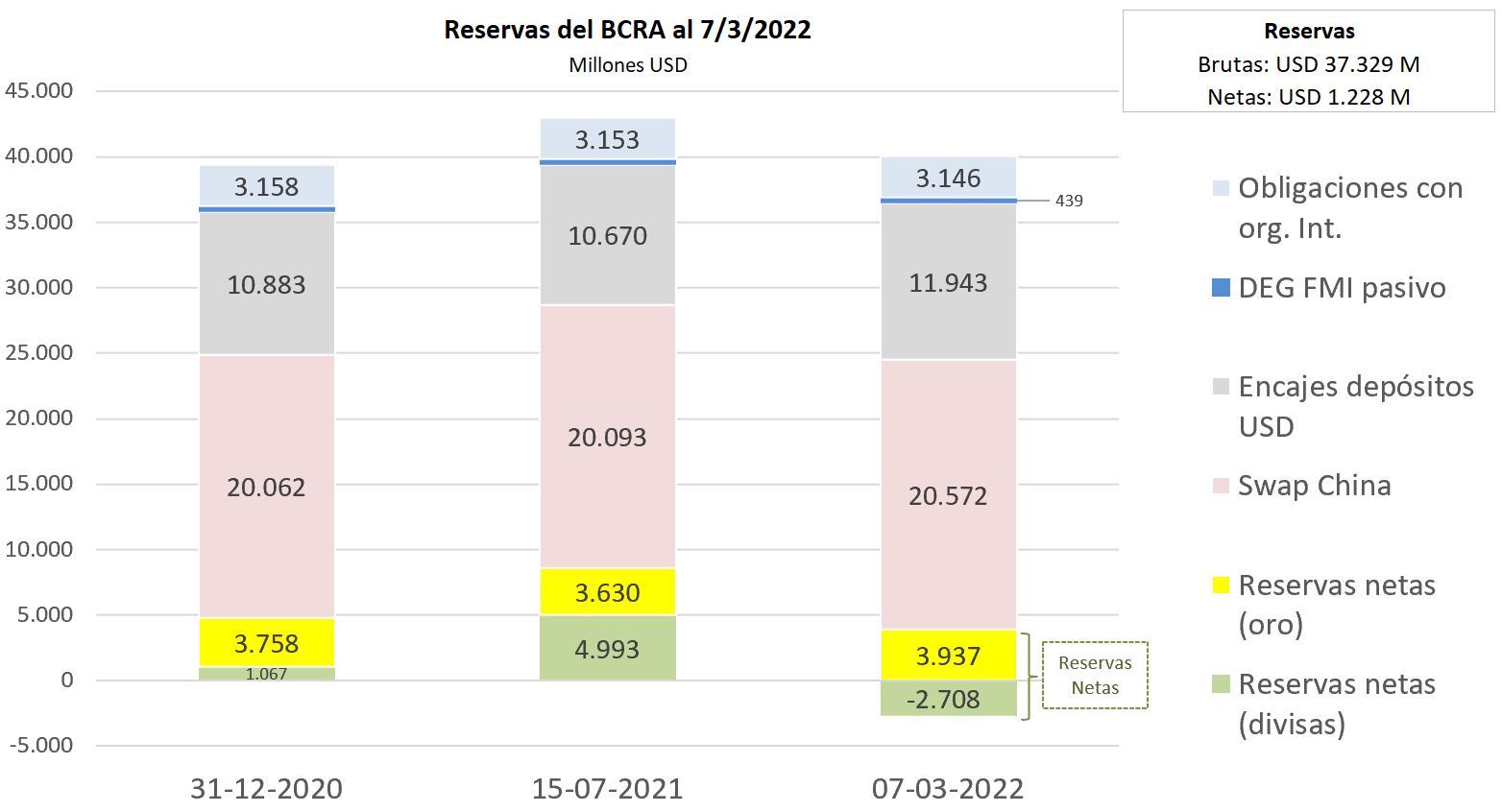

A report by GERES (Economic and Social Reality Study Group) specified that according to the Central Bank's latest balance sheet, updated as of March 7, BCRA's net reserves (discounted private loans and deposits) stood at USD 1,228 million, while liquid reserves (not considering gold holdings for USD 3.937 million) were negative at USD 2,708 million. Total reserves reached $37.329 million by the end of the first week of March.

KEEP READING:

Últimas Noticias

Debanhi Escobar: they secured the motel where she was found lifeless in a cistern

Members of the Specialized Prosecutor's Office in Nuevo León secured the Nueva Castilla Motel as part of the investigations into the case

The oldest person in the world died at the age of 119

Kane Tanaka lived in Japan. She was born six months earlier than George Orwell, the same year that the Wright brothers first flew, and Marie Curie became the first woman to win a Nobel Prize

Macabre find in CDMX: they left a body bagged and tied in a taxi

The body was left in the back seats of the car. It was covered with black bags and tied with industrial tape

The eagles of America will face Manchester City in a duel of legends. Here are the details

The top Mexican football champion will play a match with Pep Guardiola's squad in the Lone Star Cup

Why is it good to bring dogs out to know the world when they are puppies

A so-called protection against the spread of diseases threatens the integral development of dogs