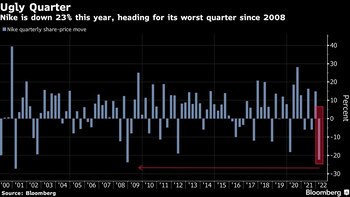

(Bloomberg) In an industry under pressure from rampant inflation, Nike Inc. is taking the brunt as its exposure to the consequences of the war in Ukraine and supply chain problems steered its actions towards its worst quarter since 2008.

So far this year, the stock has fallen by 23%, almost twice the rate of 12% decline in discretionary consumption of the S&P 500 index, while the highest inflation in decades hurts consumer confidence and pockets. The company will report the third fiscal quarter earnings after the markets close on Monday.

Production deficits and transport delays in particular make the report “difficult to predict,” according to Morgan Stanley analyst Kimberly Greenberger. Even if the company delivers better-than-expected results, uncertainty around drivers of poor performance in China, the potential impacts of the Russian invasion of Ukraine, and inventory levels could keep stock range limited.

“Q3 results are unlikely to resolve these persistent debates, delaying any requalification of the material assessment to the Q4 earnings report (in June) or beyond,” Greenberger wrote in a note last week. Nike shares fell by up to 2% on Monday.

Recently, BofA securities analyst Lorena Hutchinson reduced her earnings per share estimates for fiscal years 2022 and 2023, citing exposure to Russia and Eastern Europe, as well as covid-related volatility in China.

Even so, analysts are still largely positive about Nike, which has 28 buy, 7 hold and 1 sell ratings, according to data compiled by Bloomberg. Although several analysts have cut their price targets before profits, the analysts' average target still implies a 30% return potential for the next 12 months.

“We see a compelling buying opportunity for one of our favorite stories of long-term growth,” Beth Reed, an analyst at Truist Securities, wrote in a note last week.

Original Note:

Nike Heads for Biggest Quarterly Drop Since 2008 on Supply Woes

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.