Once the parliamentary body has passed, the agreement with the IMF is being directed to final approval by the body's board of directors, which will initialize it on Friday, March 25 , after agreeing with the Minister of Economy, Martín Guzmán, the extension until Thursday 31 of the maturities that, for a total of USD 2,782 million, Argentina had to face on Monday 21 and Tuesday 22. This allowed time for administrative procedures to avoid any possibility of arrears or delays on the part of Argentina.

Approved, the agreement will establish an economic roadmap for the coming years with fiscal, monetary and reserve targets, conditionalities, policies parallel to macroeconomic objectives, disbursements, quarterly performance evaluations and, quite possibly, revisions on some of the macro variables that were initialled and that, without having officially started the program, they were old, such as the inflation projection or the subsidy horizon.

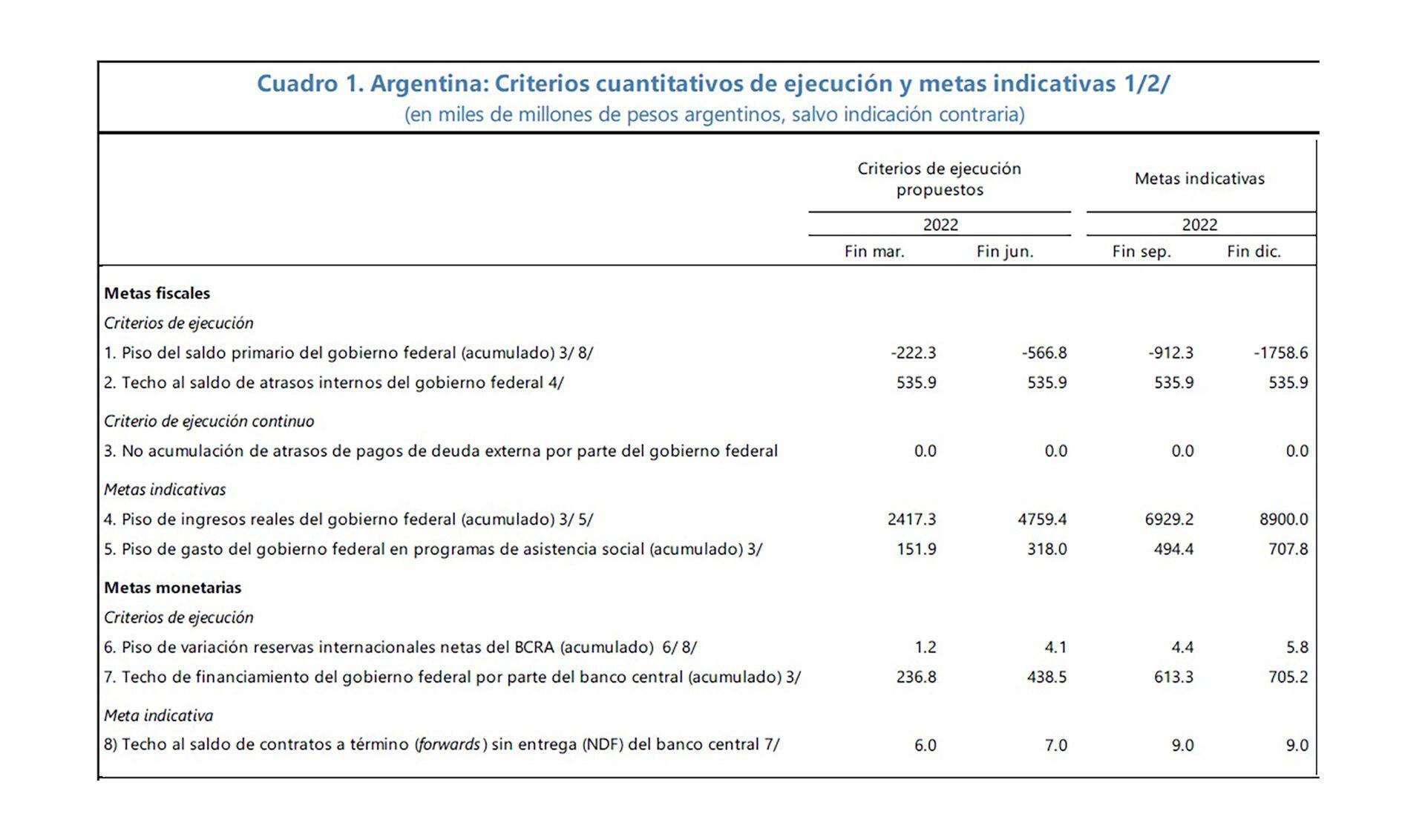

In this way, a three-level race will begin, a two-and-a-half-year log that will travel on three parallel tracks. All three are part of what was negotiated with the agency's technicians, but they will have different levels of demand and conditionality. On the one hand, the concrete goals of primary deficit, reserve accumulation and monetary financing from the Central Bank to the Treasury.

On the other hand, a battery of measures that accompany and influence these objectives: the main one is the increase in tariffs and the reduction of subsidies. And, thirdly, a group of more general initiatives: tax, legal, pension or banking regulation, among others.

The Government has admitted in the last few hours that it does not have the dollars to face on Monday and Tuesday the double capital maturity recorded by the 2018 Stand By return schedule. It is, according to updated figures, $950 million on Monday and $1,835 million more on Tuesday. In total, USD 2,785 million.

I could only face it, they admit, with the first disbursement on the agenda that would reach the Treasury once the last green light for negotiation takes place, by the IMF board. This will begin the dynamic of sending funds, which will automatically return to Washington to cover successive maturities.

The first disbursement would be 7 billion DEGs, which would represent a first draft of 9.764 million dollars (estimate by the Congressional Budget Office) and would cover the maturities to be paid to the agency in the next three months and of which would even remain a balance of USD 6.2 billion in the reserves of the Central Bank.

At the time of the first quarterly review, in June, the Government's goal would be to have another USD 4.185 million towards the Central Bank. A new turnover of USD 4.185 million is expected for September, while after the fourth review, in December, the amount that the IMF should send if Argentina meets the required targets would be USD 6,277 million more. In total throughout 2022, the Treasury would receive USD 24,411 million, about USD 7 billion more than the remaining maturities until the end of the year.

By 2023, meanwhile, the disbursements requested by the Government will be USD 5.58 billion in March, $4,185 million in June and USD 3.487 million in September and December in each case. In this way, the IMF would send $16.739 billion over the next year, which is about $2.1 billion less than the $18.8 billion that the country should repay during 2023.

By 2024 the rate of disbursements will be slower. That year there will be three more quarterly reviews, which in case the State can show compliance with the deficit, monetary assistance and reserves targets, will represent Argentina a shipment of about USD 1,116 million after each evaluation in March and June plus USD 1,135 million in September, which will be the last ones expected in September the program. That year the maturities with the Fund are USD 3,367 million.

In this way, the disbursement schedule was designed so that, on the one hand, there is a surplus of reserves that will feed the BCRA's currency buffer in this first year of operation of the agreement. The logic is that with a costly first shipment the Government will avoid quarterly situations of anxiety. That is, that every instance of IMF verification of public accounts is a source of exchange rate tensions.

The actual return of dollars would begin in 2026, that is four and a half years after the first disbursement to Buenos Aires. Talking about such a lapse of time may seem like an eternity for an economy like Argentina, but there are already forecasts of how many currencies the Argentine State should spend annually in the next dozen years to comply with the repayment.

According to estimates by the consultancy firm PxQ, in 2025 Argentina should repay USD 1,285 million in interest. Since 2026, it would reimburse capital, for 2,440 million. The roadmap continues: 6.071 billion (2027), 8,057 million (2028), 8.221 million (2029), 7.98 billion (2030), 7.738 million (2031), 6.379 million (2032), 2.561 million (2033) and will subtract only 376 million by 2034.

First goals: the numbers to watch

Firstly, there will be a series of metrics that are explicit in the fine print of the agreement with the IMF dated towards the end of March but which do not act as the first conditional barrier to disbursements. The first sending of dollars to the Argentine Treasury, as said, will only depend on the IMF board giving the green light to the new Extended Fund Facility (EFF).

Regarding the fiscal target, the figure that will act as a “floor” reference for the primary deficit of the national administration will be $222.3 billion. Likewise, it will only allow a value of 535.9 billion pesos as “floating” debt, that is to say late payments from the previous year. This last number remains fixed throughout 2022. For reference, the only fiscal data released are those for January, which showed a primary red of almost $16.7 billion.

Taking into account information from the Congressional Budget Office (OPC), which are not strictly comparable for methodological reasons, the first two months of the year, according to the OPC's calculations, were deficits for the public sector by $100 billion.

There will also be an execution criterion that the agreement considers “continuous”, and which remains unchanged throughout the four quarters: the non-accumulation of arrears of external debt payments by the government. In this regard, tolerance will be zero in the financial program.

Then there will be indicative targets for two aspects: collection and social spending. In the first aspect, the Government should have a real income of 2,417 billion pesos between the first three months of the year. In addition, there will be expenditures on social assistance programs that will have a minimum quota of almost $152 billion. According to the agreed definition, the Universal Child Allowance, Pregnancy Allowance, and Annual School Aid, the Feeding Card and the Progresar plan will be included.

On the monetary goals, linked to the management of the BCRA, there will be two execution criteria and one quantitative target. The first group lists the variation floor net international reserves of the Central Bank and the ceiling for monetary financing from the monetary authority to the Treasury. By the end of March, reserves should have increased by $1.2 billion net, while the monetization of the deficit will have a ceiling of $236.8 billion. The final goal to be met by the BCRA is intervention in the futures market, where there will be a ceiling of USD 6 billion as a balance.

The first review, then, will take place at the end of June and will be repeated every three months. At that time, the conditionality of fiscal, reserve and monetary issuance targets will begin to run. Namely:

- June targets: at that time, the primary deficit should be close to $566.8 billion, accumulated government revenues of 4.7 trillion pesos, social spending that is at least $318 billion, reserves should have increased by $4.1 billion net and the monetization of the deficit may not exceed $438 billion.

- September targets: three months later, the indicative targets towards the $912 billion primary fiscal imbalance, 6.9 billion pesos in fiscal revenue, $494 billion for social spending, USD 4.4 billion accumulated in the BCRA and $613 billion in monetary issuance for finance the Treasury.

- December targets: by the end of 2022, the primary deficit will round off 1,758 billion pesos (2.5% of GDP), 8.9 billion in revenue, $707 billion for assistance programs, USD 5.8 billion of accumulated foreign exchange buffer and $705 billion of monetary assistance to the Treasury.

What will the relationship between the Government and the staff be like

The contacts between Buenos Aires and Washington will not end up having concluded a new financial agreement, but will then open a new stage of technical talks to exchange information.

It is expected that there will be a constant flow of data between government officials and IMF. Even the agreement foresees that some data will have to be sent to Washington on a daily basis. These data include the dollar quotes, the total issued by the BCRA, deposits of financial institutions in the BCRA; liquidity assistance to banks, interest rates on seven-day deposits, foreign currency positions of banks and BCRA's activity in the future dollar market.

Others will have weekly frequency: sales and purchases of securities settled in different currencies, registered and provided by the National Securities Commission, including negotiations of the BCRA. “This information will be transmitted by the BCRA and will include a report of the daily estimate of total balances and implicit exchange rates of the most representative securities negotiated in the CCL and MEP modalities and operations,” the memorandum states.

There will also be biweekly data such as interest rates on local bonds, monthly such as public sector income and expenditure, services and debt balances, banking sector reserves, deposits, and semiannual such as Casa Rosada's expenditure on the provincial pension system and payments of arrears to ICSID court rulings, belonging to the World Bank, in addition to provincial debt data.

KEEP READING:

Últimas Noticias

Debanhi Escobar: they secured the motel where she was found lifeless in a cistern

The oldest person in the world died at the age of 119

Macabre find in CDMX: they left a body bagged and tied in a taxi

The eagles of America will face Manchester City in a duel of legends. Here are the details

Why is it good to bring dogs out to know the world when they are puppies