Alternative dollars to exchange control have in recent days reversed the downtrend that has been sustained for six weeks, since the agreement with the International Monetary Fund was announced on 28 January.

The free dollar, which came to trade at 199 pesos on Tuesday 15, but since then it took off 3.50 pesos or 1.8%, to $202.50 for sale.

As for the dollars that are traded on the stock exchange, the “liquidated spot” advanced by about seven pesos or 3.8%, to $195.47 through Global 30 (GD30C), as did the MEP, which closed a deal at $196.40 through Bonar 30 (AL30D).

What was the result of the change in market perception of the dollar? During the week there were developments that altered the prevailing “exchange rate peace”.

1) Inflation accelerated. The 4.7% Consumer Price Index (CPI) reported by INDEC surprised the Government and also the analysts, especially if we consider that the second month of the year is not seasonally the one with the highest inflation. A price increase of this magnitude has not occurred since March last year, eleven months ago.

Retail inflation increased by 8.8% in the first two months of 2022, while compared to February 2021 it increased 52.3%, according to official data.

Once the high inflation figure for February was known, released on Tuesday, alternative dollars bounced from their “floor”. The dollar's loss of purchasing power was very strong, considering that the “blue” is 5.50 pesos or 2.6% below the $208 at the end of last year, when inflation accumulates 10 percent.

In a year-on-year comparison, the free dollar rises by 41%, with inflation escaping above the 50% threshold. “With the inflation figure, the decline in the dollar ended. You can't sustain dollars going down with inflation of 5% per month. The dollar is yet another price in the economy, if everyone is rising at such a high rate, why shouldn't the dollar do it?” , reflected financial analyst Christian Buteler.

“We will have to follow it closely and see if it is a change in trend, or if it will remain stabilizing at these levels - which we do not rule out if we consider that the strong season of agricultural liquidation will begin soon. The problem is that there are a lot of pesos going around, the maturities are getting bigger and the issue is growing,” said Ariel Manito, commercial manager of Portfolio Personal Inversiones.

2) Little room to delay the official dollar. In the same vein, the gradual rise of the official exchange rate, called crawling-peg, is also beginning to be prevented, given its limited effect in curbing inflation and, at the same time, the disincentive it represents for exports.

Lucas Yatche, Head of Strategy and Investments of Liebre Capital, observes “a context of strong inflationary expectations for the coming months, where the increase in peg crawling, the thawing of tariffs, the increase in international commodity prices, the seasonality of March/April of the textile/education sector, among others”.

In this regard, the memorandum of understanding with the Fund does not foresee significant devaluation, but stipulates that “the rate of adjustment to the official exchange rate will maintain the effective real exchange rate in 2022, generally unchanged with respect to 2021 levels, in order to preserve competitiveness”, which in fact will imply a devaluation that should respect the pace of inflation.

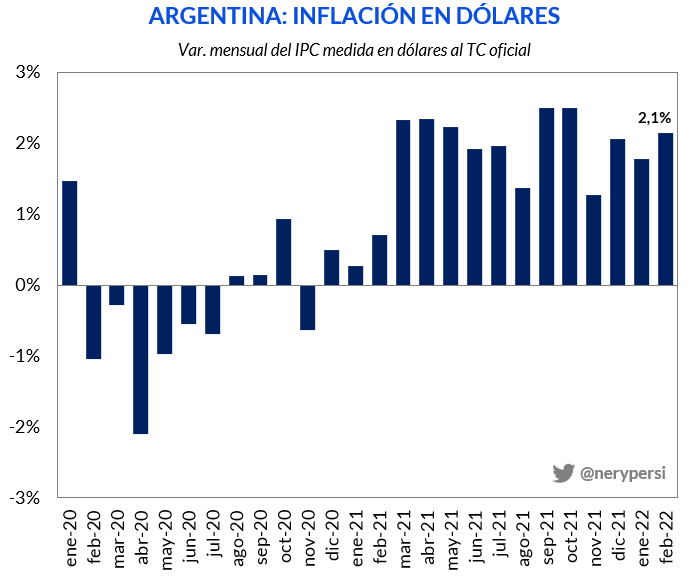

Nery Persichini, Head of Strategy at GMA Capital, stressed that “real appreciation is synonymous with dollar inflation. For almost a year, the cost of living has averaged 2% per month in hard currency”, according to the upward path of the official exchange rate.

3) The dollar limit “saving”. The price of the dollar accessed by the public in banks, today around $190, with the quota of USD 200, is also a sign of reversal for alternative quotes to the “stocks”. And in the last week, the dollar to which the 30% surcharge for the PAIS tax is applied and 35% as an advance of earnings came to be offered more expensive than MEP and “liqui” variants, before the bounce is triggered.

4) Difficulty adding reserves. In March, the Central Bank had a very important buying rate of foreign exchange in the wholesale market, for almost USD 600 million, and this income of dollars had helped to calm the devaluation expectations for the short term. It should be noted that gross international reserves are at their lowest level since the end of 2016 and when accounting for liquid dollars, they are negative, since they are basically made up of private loans and deposits.

But after the decision of the Ministry of Agriculture to suspend “until further notice” the approval of applications for the Affidavit of Export Operations (DJE) of soy by-products, such as flour and oil, the amount traded in the spot segment returned to levels close to USD 200 millions a day, which resulted in a brake on the purchase of the monetary institution's reserves.

A report by Quinquela-Megainver indicated that “foreign exchange surpluses are needed to accumulate reserves and this depends on the climate factor and international prices. The war conflict in Europe adds uncertainty and becomes a risk, especially because of the cost of energy and imports.”

5) Raise Fed rates. From abroad also came a bullish signal for the dollar at the domestic level. On Wednesday, the US Federal Reserve reversed its ultra-lax monetary policy of the COVID-19 era, to intensify its fight against persistent inflation in the US, by announcing the first in a series of expected interest rate hikes this year.

The observed maximum prices for commodities could be adjusted due to the strengthening of the dollar, underpinned by higher returns from betting on rates in the US. It should be remembered that grains reached record values in almost a decade and that crude oil peaked in almost 14 years.

Although Argentine exports, based on agricultural production, could suffer, in part this effect could be neutralized due to Argentina's dependence on energy imports, which would also fall in prices.

A global strengthening of the dollar also affects Argentina on the trade side, if a decline in the prices of exportable products is combined with a depreciation of the currencies of the main countries that demand them: China and Brazil.

KEEP READING:

Últimas Noticias

Debanhi Escobar: they secured the motel where she was found lifeless in a cistern

Members of the Specialized Prosecutor's Office in Nuevo León secured the Nueva Castilla Motel as part of the investigations into the case

The oldest person in the world died at the age of 119

Kane Tanaka lived in Japan. She was born six months earlier than George Orwell, the same year that the Wright brothers first flew, and Marie Curie became the first woman to win a Nobel Prize

Macabre find in CDMX: they left a body bagged and tied in a taxi

The body was left in the back seats of the car. It was covered with black bags and tied with industrial tape

The eagles of America will face Manchester City in a duel of legends. Here are the details

The top Mexican football champion will play a match with Pep Guardiola's squad in the Lone Star Cup

Why is it good to bring dogs out to know the world when they are puppies

A so-called protection against the spread of diseases threatens the integral development of dogs