The acceleration in inflation that has been reflected in Argentina since last year, and which worsened during the first two months of 2022, is deepening a trend that has already been observed in recent years, based on the constant loss of consumer purchasing power: smart buying. Sales in supermarkets, self-services and warehouses continue to grow strongly - the lean comparison base of the first two months of 2021 has a lot of impact - but those who make purchases became, with inflation, increasingly resourceful. In this election, big chains, own brands, second and third brands and products with controlled prices (Care Prices) win.

The wide price gap between the various channels led to the advantage of the modern channel from the pandemic. The price freeze (maximum prices) and all the programs subsequently defined by the Ministry of Commerce are unfulfillable in the traditional channel, so the big chains not only attracted the retail consumer, but also the warehouses themselves, who often get better prices there than at wholesalers. With increasing inflation, although the data for January and February showed a very good performance of self-service services compared to last year, which had been very negative for them, large supermarkets continue to win the bang.

While controls in large chains no longer cover all products, but Internal Trade concentrates on careful prices (which number about 1,300), consumers also choose this channel not only because they find products at controlled prices, but because chains carry out far more promotions than small ones shops, in addition to the multiple forms of payment. The “commercial events” that large supermarkets used to do two or three times a year, today already represent a permanent policy, assured a supermarket source.

On the other hand, what the supermarkets own brands had lost from participation in the face of the leaders, when all prices were frozen for almost a year in the midst of the pandemic, is recovering, they said in the sector. In one network they said that if they had reached a peak in share at the end of 2019 (21%), the following year that number dropped to 17%, and “it is only now recovering.”

“The price gap between cared and non-cared products is increasingly widening and that generates an opportunity for the own brand, which has the same quality as a first brand, but which sells between 10 and 15% cheaper,” the source added.

The commercial director of the Nielsen consultancy, Javier González, said that today he is seeing “what was already seen towards the end of 2021: a super specialist consumer who in some categories seeks premium brands and the best discounts, and in others, second-brand products”. Today there is not a consumer like in 2001, who bought every brand of his own, he added.

On the other hand, today the products of the Pricos Cuidado programme total 1,300, more than double the number that existed prior to the arrival of Roberto Feletti in Internal Trade. This increase, coupled with the fact that there is a predominance of top brands, means that the share of these foods in the total sales of the chains is greater, in addition to the fact that their sales grew. According to the director of Nielsen, it currently reaches 20 percent.

Smart shopping

For consumer analyst Facundo Aragon, partner of the consultancy firm Compass LA Business Analytics, “there is increasingly a constant search for consumers to make a purchase as intelligent as possible, taking advantage of promotions, and prices and offers from channels. In supermarkets there is a lot of impact from private brands, which continues to grow, and large manufacturers are constantly analyzing how to re-attack that world of B-brands.”

In turn, the manager stated that in some socio-economic sectors “some expenses are restricted on outings but there are luxuries within the home”.

“Between going out and buying something premium and eating it or drinking it at home, many consumers opt for this second option, and in the process they save. There are some segments that grow. Another example is that of women, who have not returned to hairdressers and are buying the best products for the home, for example, dyes,” said Aragón.

Leonardo Alaniz, from the consultancy firm Scentia, agreed that in some categories that generate gratification, such as wines, since the pandemic, there has been a change in the consumption pattern towards better labels and snacks. “It's a trend that started in 2020, with consumption at home, and that is still being seen. It also plays that the role of careful prices and own brands for many categories make you go to much more rational consumption,” said Alaniz, adding that beyond the good performance of self-services during the summer, “inflation favors modern channels.”

While food has a more inelastic demand for inflation than other categories, since food is the last thing abandoned when real incomes shrink, another response of consumers to accelerating inflation is the abandonment of one category and replacing it with another substitute. Although “when the market shrinks, before leaving a category, first we move to the own-brand product, then to the cheapest one, and only as the last option is that product abandoned,” they said in one of the big chains. But in some categories, such as soft drinks for example, consumers prefer to stop consuming them before turning to the cheaper brand.

Extending the useful life of products is another strategy that consumers appeal to in times of high inflation and falling real income, they said in the firms consulted.

Why is mass consumption growing?

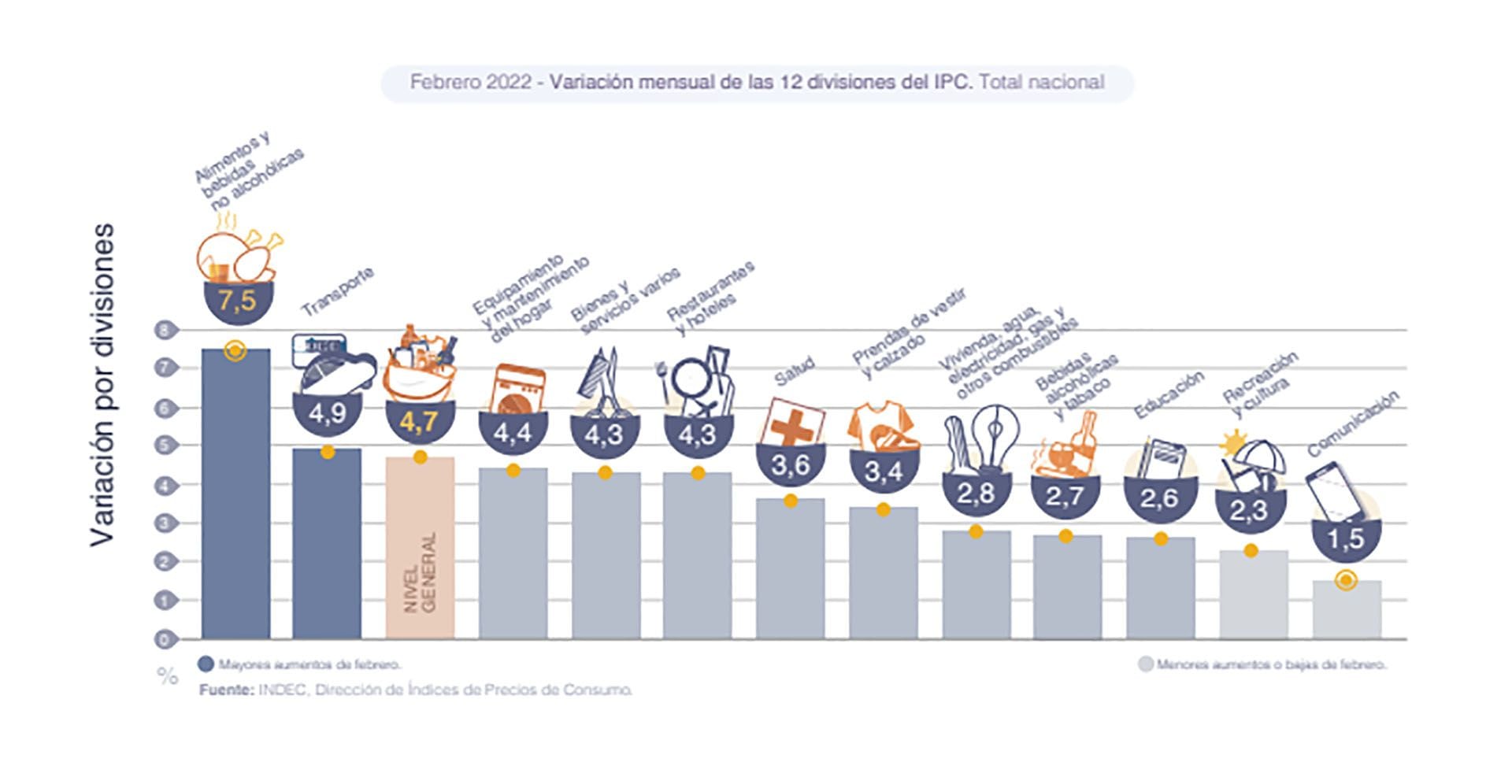

Despite this scenario, mass consumption continues to show very encouraging figures. The latest data from Scentia for February recorded an increase of 9.9% compared to the same month last year, with an increase of 16.6% inland, and just 0.6% in the AMBA. This is because there was a shift in demand inland as a result of the holidays. In the case of self-services, sales grew by 14.7% at the country level, with a 24.6% increase inland and a 1.8% drop in the AMBA. Meanwhile, in the modern channel sales rose 4.7% year-on-year, with 6.2% domestically and 3.2% in the AMBA.

Analysts' estimates of these positive figures, even in a context of high inflation, are that, on the one hand, income recovered - much more so in the formal sectors - and, on the other, it is being compared with the first two months of last year lean in terms of consumption. Anyway, González remarked, “if tariffs increase and inflation continues to accelerate, there will be a worse second half of the year. But we are still comparing against a not so good semester,” he said, while noting that after the peak of year-on-year recovery in mid-2021, then the rise slowed down, and the trend can continue like this.

“We don't see total consumption dropped. But if I start to crumble, we see that foods, basic and non-basic, are already beginning to show a brake,” said the Nielsen manager. In turn, his colleague from Scentia stressed that 2020 and 2021 are not years to buy so linearly, since they were very complex and irregular. Last year, moreover, it was electoral, with everything it involved in terms of money on the street, which boosted consumption in the second half of the year. “If we compare ourselves to 2019, in absolute values we are just reaching those levels. For that to happen this year, mass consumption growth has to be at 3%,” said Alaniz.

KEEP READING:

Últimas Noticias

Debanhi Escobar: they secured the motel where she was found lifeless in a cistern

The oldest person in the world died at the age of 119

Macabre find in CDMX: they left a body bagged and tied in a taxi

The eagles of America will face Manchester City in a duel of legends. Here are the details

Why is it good to bring dogs out to know the world when they are puppies