40 years after the beginning of the conflict, what were the axes of the economic policy that the military government tried to carry out during the Malvinas War, what was it able to do and what were the consequences of its actions?

The first part of the question is answered in a document prepared by then-Minister of Economy Roberto Alemann a few months after the end of the armed conflict whose 40th anniversary is this year.

In “Economic Policy during the Southern Conflict”, presented to the National Academy of Economics in 1982, Alemann admitted that, after the crisis that led to the end of Martínez de Hoz's “Exchange Table” and Lorenzo Sigaut's failed experience, before the start of the war “a policy was in place aimed at stabilizing the currency by eradicating the sources of monetary inflation without disturbing the orderly functioning of markets”.

However, the operation undertaken by General Leopoldo Galtieri to regain power, “posed absolutely new and unforeseen problems,” said the economist, who died in March 2020.

“The main objective of economic policy, which at that time was to reduce inflation and lead to the reduction of the public sector, yielded after April 2 to the need to preserve monetary reserves. The Central Bank had external assets of around USD 5 billion, but the reserves available were considerably lower,” Alemann admitted, in a reference that could be assimilated to the present.

The first decision was to implement an exchange rate by limiting “the foreign exchange market to purchases exclusively for commercial and financial maturities with a certain date”. The intention, he explained, was to have “cash” for the purchase of weapons during the conflict.

On exchange rates, he explained, he tried to delay the inevitable devaluation generated by the increase in mistrust, until it allowed a 25% jump in early May, in exchange for placing export duties, an instrument that curiously several decades later was reinterpreted as progressive.

On external debt, Alemann stated that “the renewal of maturities until the conflict was overcome” was achieved with the consent of the commercial banks, which were the country's main creditors.

However, in New York they considered that Argentina was the first country to fall into default in the early 1980s, even before Mexico, at the beginning of the so-called “lost decade”.

This is because the Argentine government did not pay British banks for the Malvinas war. At the end of 1981, with a public external debt of USD 20,024 million that could barely be repaid, the military government was in the midst of erosion as a result of the economic crisis and the slow but progressive advance of political dialogue, following the toughest years of repression.

Urgently to raise funds, the minister left for the annual meeting of the Inter-American Development Bank (IDB) in Cartagena de Indias to agree to refinance the 1982 sovereign debt commitments.

The official plan was to take out some $3.5 billion in long-term syndicated loans and renew another $7.2 billion. Since March 26, oblivious to the government's war plans, the official began to weave in the Colombian Caribbean the delicate operation to remove Argentina from the ledge of default.

In return, Alemann committed to maintaining public debt and reducing the fiscal deficit by 2% during that year. Reality would break with his oath, since by the end of 1982 the external liabilities of the State would amount to USD 28,626 million.

With less hesitation than José Martínez de Hoz to implement an adjustment program with the aim of reducing inflation, the minister designed a scheme of “rationalization” of public spending together with the Ministry of Finance, which had tried the same task without success since 1976 under Juan Alemann's orders. Thus, Alemann ordered a freeze on wages and a cut in subsidies to state-owned enterprises.

After reaching a quick “verbal commitment” for debt refinancing, the minister decided to advance his return by two days with a stopover in Bogotá, to arrive on March 30 in Buenos Aires. However, the air routes did not favor his plans and he had to spend 25 hours between one plane and another to reach the country through Brazil.

Finally, he landed on Thursday afternoon at Ezeiza airport, where, anxiously, Solanet was waiting for him to explain that the Air Force's liaison with the Ministry of Economy had anticipated him the night before that on April 2 there would be important developments in relation to the islands of the South Atlantic.

Following the military operation, the Treasury ordered the president of the Central Bank, Egidio Ianella, to transfer the international reserves of the Central Bank that were deposited with the Central Bank of England and the commercial banks of the United States. The new destination would be the International Bank for Settlements Basel, the International Monetary Fund (IMF) and the New York Federal Reserve, far from the scope of a possible British embargo.

Exhausted by the long trip from Colombia, Alemann told Solanet at the airport that nothing would happen in relation to Malvinas and that he needed a nap at home to regain his strength. At 19, his collaborator woke him up by phone to reaffirm his fears, but Alemann again asked him to calm down, until at one in the morning on Friday the minister was summoned to an emergency meeting of the national cabinet at 7 in the morning at the Government House to discuss an invasion that he was not aware of.

Angry and confused, Alemann felt that in an instant his house of cards collapsed: the long-awaited fight against deficit and inflation gave way to military spending as a priority of economic policy.

While the minister became aware of the change of scenery, Ianella made sure that the operation to rescue the reserves was “practically” successful, since there were still 50 million pounds sterling that could only be released on Friday, April 2, for operational reasons. The Ministry of Economy took advantage of the slow pace of the British government to react — Premier Margaret Thatcher had allegedly learned about the Argentine military operation through US intelligence early Friday and imposed capital control only on Saturday — to save that remaining money.

However, inside the English financial system, some USD 1.45 billion Argentine residents would be frozen throughout the war, including 70 million members of the Argentine Navy's arms purchase commission, which a member of that force even less informed than Alemann forgot to withdraw.

In the war economy, Alemann would limit the purchase of currency to avoid capital flight, the foreign exchange market would redouble, the peso would devalue, export withholdings would grow and other tax measures would be taken to address the growth of military resources, which consumed USD 450 million. current expenditure, plus funds for the purchase of aircraft.

Despite the rhetorical support of the private sector for the minister's plans, the flight of 4% of total deposits from the local financial system recorded during the first week of April demonstrated the nerves of the market in the face of the war against the planet's main maritime power.

While Argentines withdrew their deposits from banks in Buenos Aires and forced the BCRA to lower the market to combat the illiquidity situation in the market, in the heart of the war conflict the military administration managed to maintain some confidence in the islands' population.

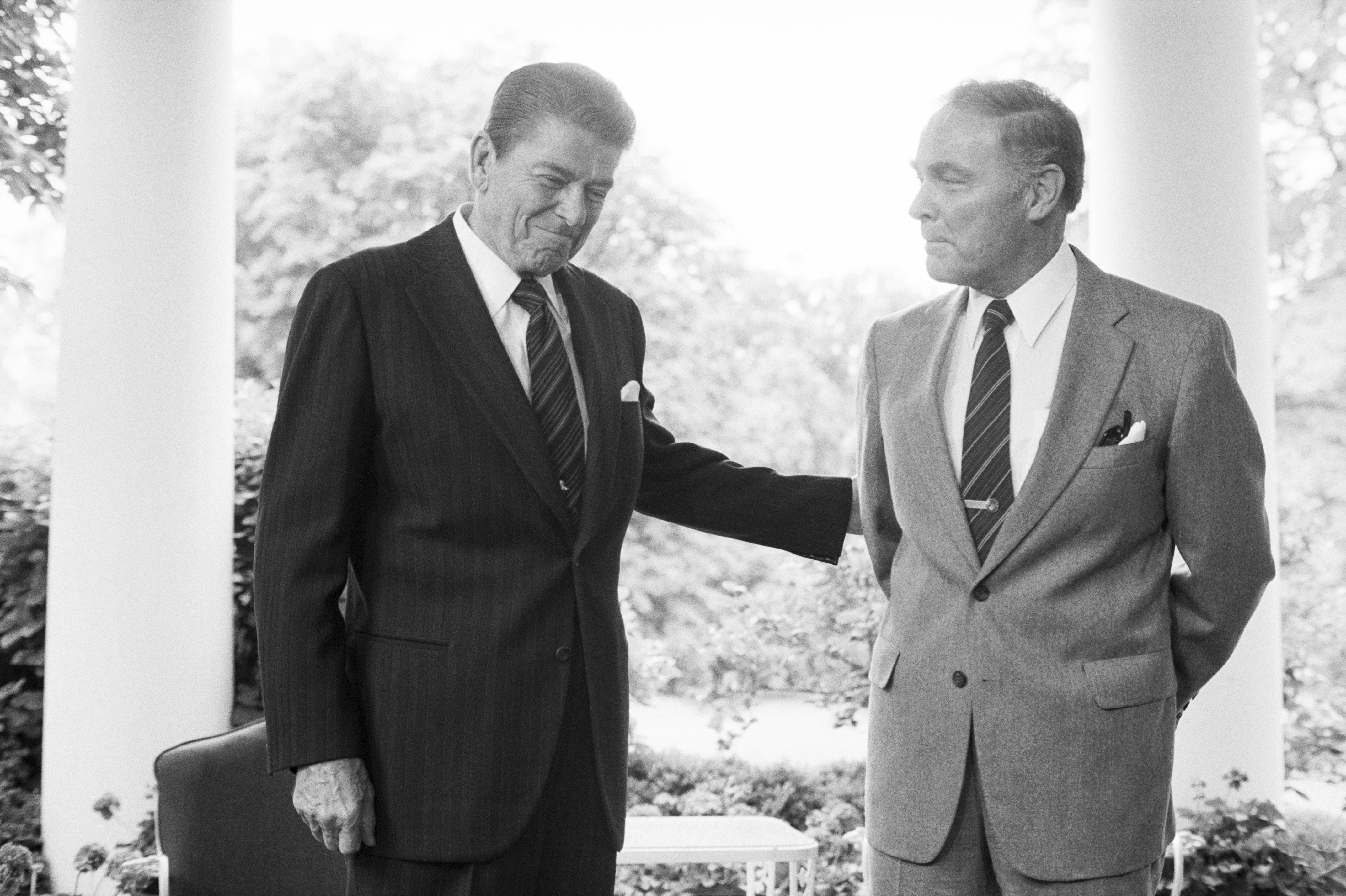

In this regard, the military government promised not to seize the assets of the kelpers and to maintain stability, through a bimonetary regime with a fixed exchange rate (at 20,000 pesos per Falkland Islands pound) established after a trip by an economic official to Puerto Argentino in mid-April, when diplomatic mediation of the United States government, led by Alexander Haig, had already failed.

Meanwhile, with the support of its NATO allies and the European Economic Community, Great Britain ordered the freezing of Argentine funds and the embargo on imports of domestic origin. In Argentina, the toughest sector of the Military Junta called in retaliation for the confiscation of British property.

Alemann did not accept, but without hesitation suspended the payment of the capital maturities of the foreign debt in order to preserve the level of reserves of the Central Bank, generating a hysterical reaction among bankers around the world. Although the minister assured that the measure was based on the war context, his closest collaborators knew that the war would allow us to hide a default that was latent, because there was only money to pay one or two months of maturities.

Lloyds Bank in the United Kingdom was the country's main individual creditor, and Argentina had taken much of its loans through syndicated loans, which all banks collected through a single window. If I didn't charge one, no one charged.

Alemann then understood the ineffectiveness of remote messaging and traveled to a meeting of the International Monetary Fund in Helsinki, where on May 12 he tried without too much success to obtain the support of the agency's head, the Frenchman Jacques de Larosiere, to achieve an assistance program with the complicated promise of continuing with an adjustment. Discouraged, he left Finland and steadily began a tour of Zurich, Paris and New York to offer non-British private creditors the possibility of effectively meeting the maturities of interest payments through an account with the Union of Swiss Banks (UBS). In parallel, an escrow account would be set up to record commitments to English banks without paying them, until London lifted sanctions against the country.

This solution came up with lawyer Richard Davis, partner of the New York firm Weil, Gothsam & Manges, former Treasury Undersecretary of Finance during the James Carter administration and expert on international economic sanctions, hired by the Ministry of Economy for fear that the Reagan government would cede to the pressure from Thatcher to seize Argentine assets on United States territory.

In fact, Davis merely recommended to the Argentine government a formula similar to the one used by the Iranians during the hostage-taking at the US embassy in Tehran, to avoid the freeze ordered by the Treasury at that time. Davis began his work with a visit to Buenos Aires, before English troops reached the South Atlantic, in which he suggested minimizing incentives for banks to declare a formal default.

While repressor Alfredo Astiz surrendered without fighting in South Georgia, the minister was reassured when non-British banks resigned themselves to accepting the Argentine proposal, which even received praise from the US Treasury.

However, inside the country, Alemann had to endure the anti-Semitic reaction of some members of the Military Junta, outraged by the Weil, Gothsam & Manges studio's strong ties to the Jewish community in New York.

On June 14, 1982, the Argentine military surrendered to their British counterparts in Puerto Argentino. The dictatorship definitively sealed his fate at the cost of the death of 649 Argentine soldiers in a war that Galtieri sought to win with the hope of receiving help from the United States.

Along with the defeat on the battlefield, the country was accumulating at the end of the war some $2 billion in arrears in the debt that it had to begin to renegotiate the day after the surrender in the South Atlantic.

However, Alemann stated that “markets functioned normally and economic policy measures contributed to their better functioning, with the exception of trade and payments abroad, where unfair sanctions by other countries forced us to respond promptly without affecting Argentine credit abroad or functioning of the Argentine economy as a whole”.

After that tragic experience in the Malvinas, Galtieri resigned and took over Reynaldo Bignone, in an economically disorderly management, with continuous negotiations with creditors to get out of default.

On October 4, 1983, 26 days before the elections that marked the democratic return and promotion of Raúl Alfonsin to the government, the president of the Central Bank, Julio González del Solar was arrested on his return from Washington on charges of “treason of the homeland”, under the orders of Oscar Pinto Kramer, a judge from Rio Gallegos who echoed the anger of the Air Force that the government had taken Aerolineas Argentinas as a witness case for the restructuring of the debt of public companies, in accordance with the assistance program signed earlier that year with foreign banks.

On September 21, the military pilots had expressed their “unanimous displeasure at the way in which the airline debt was renegotiated,” while González del Solar and Economy Minister Jorge Wehbe begged the creditors' committee to postpone the ultimatum against Argentina, because the government had failed to comply with its payments throughout the year.

The judge based the arrest warrant of the head of the Central on two clauses of the agreement: one that granted an official guarantee for restructuring and the other that ceded the competence to settle any judicial dispute to foreign courts.

With some fear of the judicial decision, the steering committee postponed its intimation of the government. On October 6, González del Solar was released by a decision of the Federal Chamber, which accused Pinto Kramer of placing the country “on the brink of a default”, which in fact had been in effect for more than a year in practical terms and which, in fact, would last almost a decade more until Argentina signed the Brady plan at the beginning of the decade of the 90th.

KEEP READING:

Últimas Noticias

Debanhi Escobar: they secured the motel where she was found lifeless in a cistern

The oldest person in the world died at the age of 119

Macabre find in CDMX: they left a body bagged and tied in a taxi

The eagles of America will face Manchester City in a duel of legends. Here are the details

Why is it good to bring dogs out to know the world when they are puppies