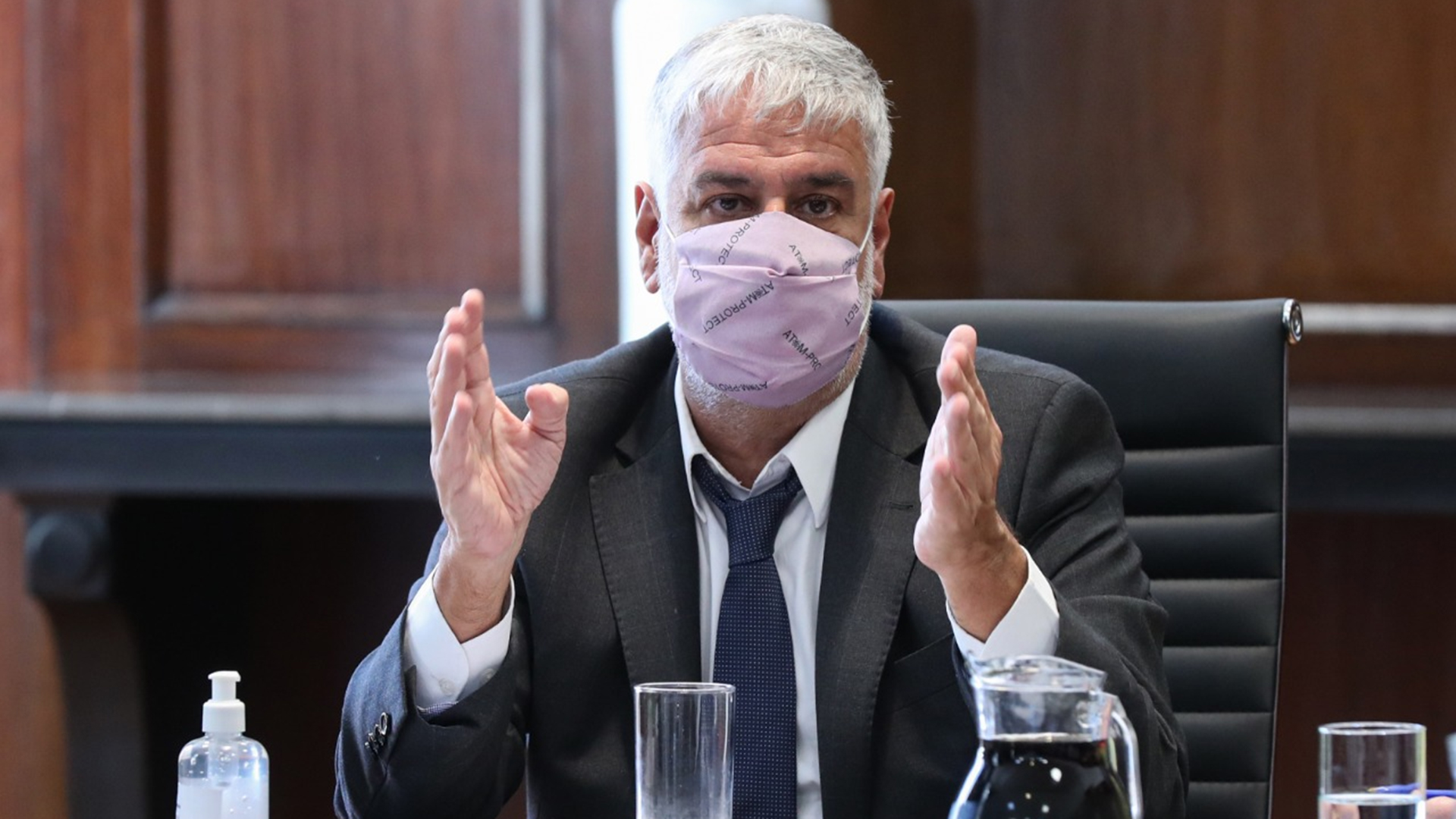

After a rough meeting, as described by some of the participants, the meetings of the Bureau of Rentals that were taking place at the Secretariat of Commerce between Secretary Roberto Feletti and various tenant associations, chambers of real estate agents and owners were suspended.

The point of conflict, according to sources, was the proposed amendments to the Rent Act. Real estate companies and landlords wanted to move forward on a change in contract deadlines — going from three years to two years — and on a biannual update of rents compared to the annual update in force today. However, the Tenants Federation rejected any proposed change in the law, which has been in force since June 2020.

There was also divergence in how to stimulate a greater supply of rents: tenants propose idle housing tax and landlords lower taxes for residential rental housing.

“It was resolved not to continue discussing the amendment of the Rent Act because there is no agreement between the market and the Tenants Federation. The market wants to modify it and we don't,” said Gervasio Muñoz, of the National Tenants Federation.

Its proposals are the regulation of the initial rental price (2% of the tax value of the house) and a 5% tax on the tax value of empty homes for more than two months for all those who have more than three properties. Both measures are rejected by the real estate sector. At the meeting, officials of the Ministry of Commerce announced that their implementation would be analyzed, but did not give further details.

According to the participants, due to the lack of agreements, the decision of the Ministry of Commerce is not to convene any further meetings of the Rents Bureau in the short term. However, they did not rule out that there could be more technical meetings, with the chambers in particular, to discuss the measures implemented by the Government on the subject.

“There was no agreement. There are extreme positions, which was not the idea. Real estate agents know how to recover the market. Secretary Roberto Feletti was willing to listen to all sectors. But it is very difficult to find a balance when tenants do not accept any modifications,” said Marta Liotto, president of the Single College of Real Estate Brokers of the City of Buenos Aires (Cucicba)

The Argentine Chamber of Real Estate (CIA), the Real Estate Federation (FIRA) and the Buenos Aires Association of Martilleros (Cucicba), in a letter, indicated that establishing a tax on “idle housing” or “a maximum supply value” will not contribute to increasing the supply of rental properties.

“Depending on the marches and countermarches that this issue has generated in society, it could only deepen the withdrawal of the supply of a larger number of units, increasing the problem discussed today in this table, redirecting the private sector its savings to other types of investments that are less discouraging and with greater legal certainty”, they said.

The proposals of the sector were:

- Implement measures to improve access to soft loans for the purchase of the first home

- Encourage owners to use their property used for rent or the investor who acquires, builds, remodeles or refurbishes properties for rental housing.

- Amend the Rental Law to allow a price update at least six-monthly and a reduction of the minimum rental period to two years.

However, from the Argentine Real Estate Chamber (CIA) they rescued meeting points as the intention of increasing the supply of rental properties. “The Secretariat is studying setting up technical tables at the regional and provincial levels in order to visualize the different positions in the country,” said Alejandro Bennazar, president of the CIA. And they assured that they will continue to work to provide solutions to the problem of rentals.

For their part, the owners also presented a series of initiatives. One of them was the reduction of the tax burden on rents: income tax, personal property tax, tax on bank debits and credits, gross income tax, property tax and stamp tax. “The total of this burden usually exceeds 50% of gross rents. The tax burden is composed of direct and indirect taxes, but each and every one, to a greater or lesser extent, affects landlords and tenants. This is manifested in a total or partial translation to the value of the location or in the reduction of the supply of real estate for a location,” said Claudio Oseroff, of the Neuquén Chamber of Property Owners.

The owners proposed to establish exemptions or differential rates in personal property tax for rented property. According to the meeting, the annual return on renting a property is 2.2% per year and recovering investment demands between 45 and 50 years. “There is no investment that has only begun to be recovered in 45 years. We understand that rent is not profitable and that tenants cannot afford to pay either,” Oseroff said.

KEEP READING:

Últimas Noticias

Debanhi Escobar: they secured the motel where she was found lifeless in a cistern

The oldest person in the world died at the age of 119

Macabre find in CDMX: they left a body bagged and tied in a taxi

The eagles of America will face Manchester City in a duel of legends. Here are the details

Why is it good to bring dogs out to know the world when they are puppies