The surprising 4.7% Consumer Price Index (CPI) for February strengthened Argentina's proximity to a group of countries with the highest inflation rate in the world. President Alberto Fernández announced that a “war against inflation” has begun, but the government has been defeated, and wants the country to be still far from hyperinflation, as Venezuela is experiencing A few battles that are close to a world record.

4.7% in February, which accounts for 8.8% in the first two months of the year, is so high that it risks the 43% inflation pattern established in the agreement with the International Monetary Fund (IMF) prematurely. In addition, the agreement includes two decisions that will directly affect the price. With the thawing of utility tariffs and the acceleration of the devaluation of the peso, it will no longer return to inflation, as happened in 2021.

The Market Expectation Survey (REM), conducted by the Central Bank, showed that inflation in 2022 exceeded 55% above the official pattern agreed with the fund and 52.3% inflation compared to the previous year in February.But at the same time, other factors that push the upward outlook added to what has already been mentioned are the inability to continue stepping on the dollar and tariffs. One of them is that a 9% increase in fuel results in a “secondary increase”, since it affects the distribution of many products. The increase in goods caused by the Russian invasion of Ukraine, especially the invasion of gas and oil, predicts its impact on domestic prices through various avenues.

In this way, it is not surprising that the country is one of the countries with the highest inflation worldwide. According to estimates from the International Monetary Fund (IMF), only four countries in the world, whose inflation rate was more than 50.9% in Argentina in 2001, were only four out of a total of 200 countries that were relaxed by multilateral organizations.

According to the IMF, the country that surpassed Argentina last year was Venezuela, which, according to the IMF, was 2,700% (the official national figure was 686.4%, which slowed from almost 3000% in 2021); Sudan, 194.6%; Zimbabwe, 92.5%; and Suriname registered 54.4%. These are countries that are experiencing scenarios of war conflicts, autocratic regimes and harsh internal crises.

Venezuela has lacked inflation control over the years. Amid restrictions and problems with the supply of all kinds of products, the country emerged a few months ago in the context of hyperinflation since 2017. In December, the Central Bank of Venezuela (BCV) reported a CPI of 7.6% and recorded a figure of less than 50% compared to the previous year, which is the hyperinflation threshold for 12 consecutive months.

Despite the turbulent economic and social situation, Venezuela's inflation rate for February was lower than in Argentina. It reached 2.9% and was for the sixth consecutive month with single-digit inflation. Analysts see the main reasons for the decline in inflation in the Bolivar rise against the dollar, a decrease in fuel subsidies and a easing of exchange control.

Meanwhile, in Sudan (260%), an internal crisis was so strong after a military coup in October that caused a food crisis that clashed with dozens of people who died on the streets and affected 70% of the population. Last week, the Central Bank decided to completely liberate the foreign exchange market to stabilize the value of the Sudanese pound. Zimbabwe (66.1%) failed to go through the economy after 30 years of the dictatorship of Robert Mugabe, which ended in 2017 due to the omicron variant of the coronavirus and increasing political violence. Since then, inflation has been the highest in the world.

Suriname (61.5%) is eager to control inflation, which is expected to be a few percentage points higher than Argentina after sealing the $688 million program in three years with the IMF, and an immediate expenditure of about $55 million has been made. IMF Executive Director Kristalina Georgieva said, “The program is in a small country in northern South America, known as the Dutch Guiana before reserves,” said Kristalina Georgieva. This is more than half a million people.

World average and region

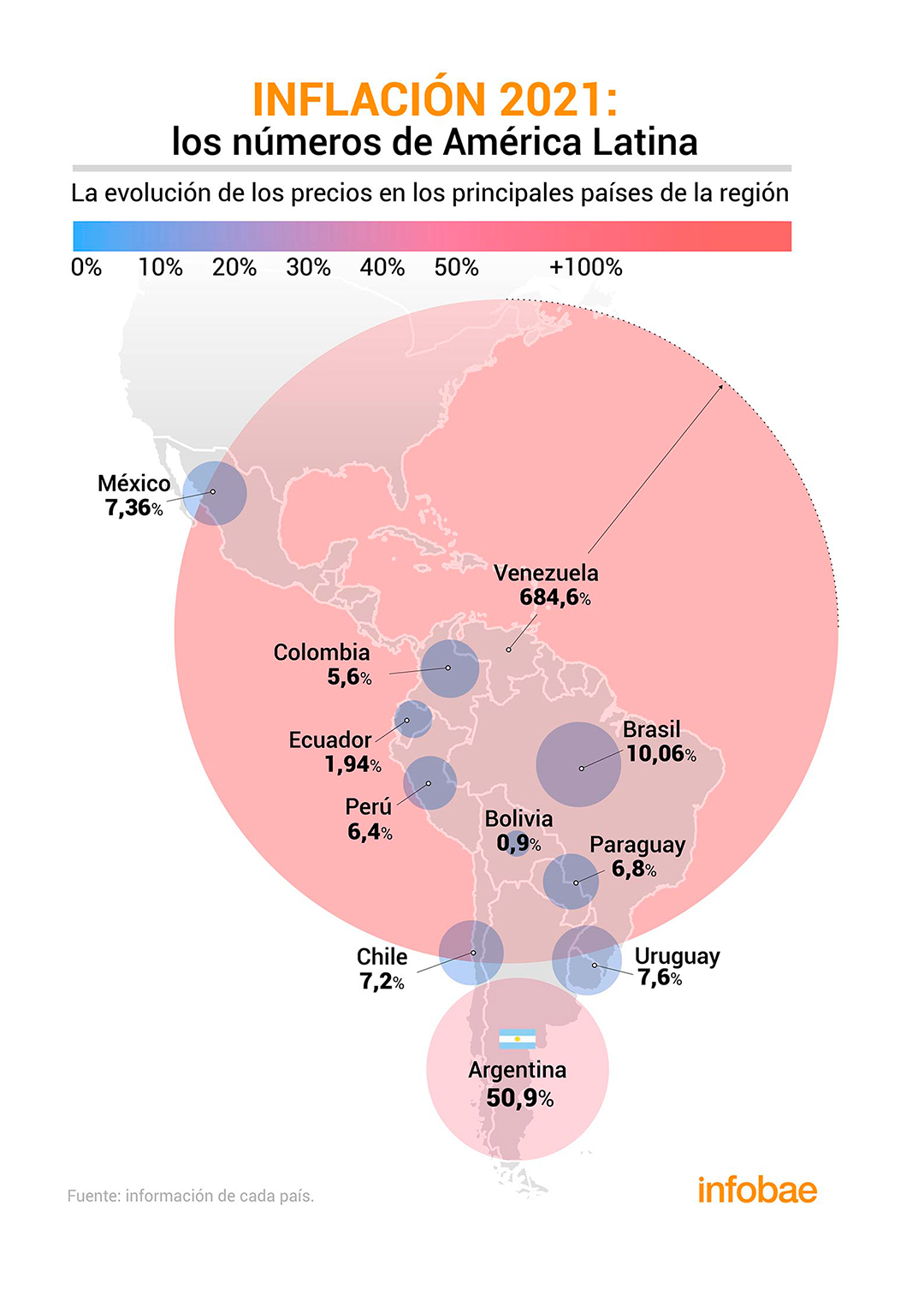

In this region, the inflation rate in Argentina is far superior to the rest, despite the fact that some countries have been on the rise since the pandemic began, although taking annual data for 2021 and already described for Venezuela. The only country that recorded double-digit inflation was Brazil, reaching 10.06%, reaching a six-year high and doubling the target of 5.25%. In all other cases, Uruguay was 7.6%, Chile was 7.2%, Paraguay was 6.8%, and Colombia 5.6%, Ecuador is 1.94%, Bolivia is 0.9%, Peru 6.4% (the highest in 13 years), Mexico ended at 7.36%.

Last year, inflation rose globally due to the impact of monetary issuance caused by government-funded programs to mitigate the impact of the coronavirus. Global inflation averaged 4.3% yesterday, slightly lower than the monthly value of Argentina, with an average of 5.5% for emerging countries and 2.8% for developed countries.

Keep reading:

Últimas Noticias

Debanhi Escobar: they secured the motel where she was found lifeless in a cistern

The oldest person in the world died at the age of 119

Macabre find in CDMX: they left a body bagged and tied in a taxi

The eagles of America will face Manchester City in a duel of legends. Here are the details

Why is it good to bring dogs out to know the world when they are puppies