Kirchnerism insists on reclaiming the wealth tax. Despite the fact that when it was approved in 2020 it was established that it was of an “extraordinary” nature, a deputy from the Front of All presented a new project to reimplement it but this time for 10 years.

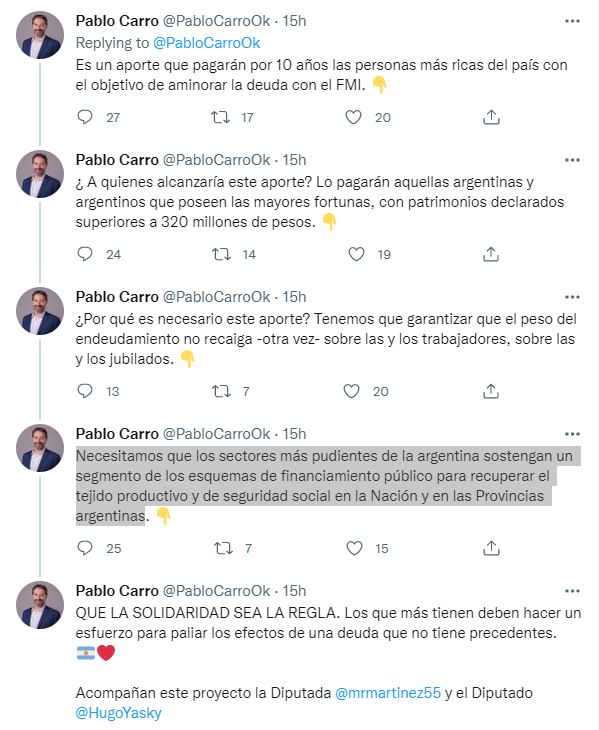

The initiative was proposed by Pablo Carro, national legislator of government government for Córdoba, and secretary general of the CTA of that province. Through his official Twitter account, he announced the presentation of the bill “Temporary Solidarity Contribution to Mitigate the Impact of Indebtedness with the IMF”. “It is a contribution that will be paid for 10 years by the richest people in the country with the aim of reducing debt (with the multilateral credit agency),” he said.

In a thread of tweets, he explained that the new tribute would be paid by “those Argentines and Argentines who have the greatest fortunes, with declared assets exceeding 320 million pesos.”

“Why is this contribution necessary? We have to ensure that the burden of indebtedness does not fall - again - on workers, on retirees”, justified the deputy of the Front of All.

“We need the wealthiest sectors of Argentina to support a segment of public financing schemes to recover the productive and social security fabric in the nation and in the Argentine provinces,” he added. The initiative is accompanied by two other Kirchner deputies: María Rosa Martínez and Hugo Yasky. “Let solidarity be the rule. Those who have the most must make an effort to mitigate the effects of a debt that is unprecedented,” Carro concluded.

The first wealth tax law, which officially bore the name of the “Solidarity and Extraordinary Contribution Act” was passed at the end of 2020 to alleviate the economic effects of the COVID-19 pandemic and the consequent quarantine that ruled for several months that year. During that debate, government legislators insisted on repeated opportunities that human persons with assets greater than $200 million would be charged “for the one time”.

The Government expected to raise around 400 billion pesos, however, a year later - in December 2021 - the Federal Agency for Public Revenue (AFIP) reported that the Treasury collected $237.3 billion, just under 60% of what was expected, paid by more than 10,000 people. The initiative sparked a wave of legal action to prevent their collection and caused companies, professionals and technicians to try their luck outside Argentina.

Despite the fact that it collected much less than intended and that it scared away investments, in the middle of last year officials in the area of Economics tried to include a new wealth tax in the draft Budget 2022. Weeks ago the idea was raised again. At a meeting of the Council of the Justicialist Party of the province of Buenos Aires, Provincial Senator Omar Plaini proposed renewing and implementing it for the duration of Argentina's debt to the International Monetary Fund. At that meeting of Peronism in Buenos Aires, Máximo Kirchner endorsed the proposal with applause. Plaini's proposal was very similar to that presented by Carro on Tuesday in Deputies.

Despite the intention of Kirchnerism, not everyone in the Government agrees to reimplement the tribute and in recent times it has aroused criticism among accountants, specialists and tax advisers.

“The reality is that the wealth tax failed: it collected little, there was a lot of litigation and in many cases the confiscation test showed that the 7.5% that yields the sum of the maximum rates of the Great Fortunes Tax (5.25%) and Personal Property Tax (2.25%) exceeded the income of the encumbered assets, affecting the right to property established in the National Constitution,” said César Litvin, of the Lissicki, Litvin & Associates studio. Anyway, he said, judicial resistance is a long way. The substantive issue, constitutionality, he said, will reach the Supreme Court of Justice in no less than five years.

“In Argentina we are used to the fact that what is done for the only time becomes permanent, but the legal nature of the 'extraordinary contribution' is clear: it is a tax and if it is repeated it will continue to be so,” Litvin warned last month in dialogue with Infobae.

The keys to the new project

The bill on temporary solidarity contribution to mitigate the impact of indebtedness with the International Monetary Fund presented this Tuesday in Deputies, specifies that it would reach:

- Human persons and undivided inheritances resident in the country, for all their property in the country and abroad, included and valued in accordance with the terms established in Title VI of Law 23.966, on personal property tax, text ordered in 1997 and its amendments, regardless of the treatment against this levy and without deduction of any non-taxable minimum, on the date of entry into force of this Act.

Likewise, those human persons of Argentine nationality whose domicile or residence is in “non-cooperating jurisdictions” or “jurisdictions with low or no taxation”, under the terms of articles 19 and 20 of the Income Tax Law, text ordered in 2019 and its amendments, respectively, will be considered subject residents for the purposes of this contribution.

- Human persons and undivided successions residing abroad, except those mentioned in the second paragraph of the previous paragraph, for all their property in the country included and valued in accordance with the terms established in Title VI of Law 23.966, text ordered in 1997 and its amendments, regardless of treatment they have against this levy and without deduction of any non-taxable minimum, on the date of entry into force of this law.

- For the subjects reached pursuant to the provisions of the paragraph, the basis of determination mentioned therein shall be calculated including contributions to trusts, trusts or foundations of private interest and other similar structures, participation in companies or other entities of any kind without tax personality and direct or indirect participation in companies or other entities of any kind, existing on the date of entry into force of this Act.

The project envisages the collection of 1.50% to the assets of individuals who declare more than $320,000,000. In cases of goods between $400 million and $600 million, they will pay 8.25 billion plus 1.75% over the surplus of $400 million; between $600 million and $800 million, they will pay $13.25 billion plus 2.00% on the surplus of $600 million; in cases between $800 million and $1.5 billion, they will pay $18,75 million plus 2.25% on the surplus of $800 million.

In the case of assets ranging from $1.5 billion to $3 billion, they will pay $39.75 billion plus 2.50% on the surplus of $1.5 billion. Whereas from $3 billion onwards they will pay $88,500,000 plus 2.75% on the surplus of $3 billion.

With regard to assets abroad, the rates range from 2.00% to 4.25% according to declared assets.

KEEP READING:

Últimas Noticias

Debanhi Escobar: they secured the motel where she was found lifeless in a cistern

The oldest person in the world died at the age of 119

Macabre find in CDMX: they left a body bagged and tied in a taxi

The eagles of America will face Manchester City in a duel of legends. Here are the details

Why is it good to bring dogs out to know the world when they are puppies